$CDLX: An Update

First and foremost -

I have not made any significant changes to my CDLX allocation over the past couple of months. It is currently ~58% of my PA and 40% of the portfolio I manage. It is possible that changes in the immediate future given incremental positive news and recent price reductions.

The obvious elephant in the room is that CDLX declined about 23% last week. Why? I have no idea. With stocks like these they seem to act as highly levered trading chips for the trading firms of the world. A view is expressed (soft landing, good economy) and the levered chips go up a lot for seemingly no reason. That view is perhaps questioned or an exit point is reached, and the price goes back down. While more extreme than most are used to, it comes with the territory of owning levered and misunderstood equities. It hurts in the near term, but not a huge deal. (There is always the possibility I simply missed some kind of news flow. I doubt it, but not impossible)

The CEO Karim also off loaded a good bit of shares earlier this month. My opinion on this has two parts

In general I probably care less than average about insider transactions. Generally (not referring to Karim here) insiders are rather poor capital allocators when it comes to the market. There are a plethora of examples of stock buy backs right before negative news, personal buys right before insolvency, etc. What matters more so to me is the reasoning behind any insider transactions. Perhaps pedantic, but a point of focus for me.

With Karim specifically - he was not an extravagantly wealthy guy prior to CDLX. He was obviously doing quite well for himself given high ranking positions at Stripe and Google, but a silly rich founder he was not. Off the top of my head he had something like $4.5m of equity when he joined, which appreciated something like 50%. I would guess that was a rather sizable chunk of his net worth, and given vesting schedules a pretty substantial tax bill. Selling some to square up hardly seems outlandish.

In summary, the reasoning behind a sale could simply be taxes as Karim is not cash rich and his stake was a substantial portion of personal wealth. The execution to date has been quite good, and the trend for Q3 seems quite positive. I currently have no reason to be concerned - but again, I can always be wrong and it’s good to file events such as this in the back of mind for any future suspicious news items.

That’s all really on the stock - my stake is up triple digits in total return, rather ridiculous. If I do an incremental add I’ll likely tweet about it.

Business Progress:

First up - a new initiative, Rippl.

Rippl is a CDLX product launch focused on advertising within retailer media using Bridg customer ID and SKU data. In simple terms, Grocery Outlet can upload their PoS data to Bridg, identify customers, work with Coke to advertise to said customers, see uplift with Bridg data.

Why is this valuable?

Effectively retailers are moving to become advertisers. Retailers already have captured consumer ears, eyes, and noses during their shopping experience. Monetizing that with ads is a natural course of action. The issue of course being, a retailer is not necessarily the best data analytics and marketing business. Partnering is a natural course of action.

CDLX (the Bridg team specifically) comes in, makes the retailer data readable and worth something, and enables the retailers to have an advertising network based on their data. Essentially it’s free money that was previously being left on the table as retailers wake up to advertising (and data enablement has improved).

The end result is the retailer pays Bridg to make more money (likely some flat fee for integration, then revenue based pricing on what advertisers spend). The amount of money Bridg will make from this is totally up in the air, can’t even begin to guess. It is clearly a valuable space, but they aren’t the only ones doing similar things. It will also likely take awhile for revenues to get somewhere super meaningful.

The real positive value in my mind from such a venture, is the relationships. Naturally, advertisers will be hearing about and interacting with CDLX. Said advertisers are specifically looking for SKU based marketing campaigns. As it so happens, CDLX and Bridg are now selling SKU based marketing campaigns via the primary offering!

A natural struggle for a business like CDLX is making potential clients aware you exist. CDLX has no branding within their primary channel, it is not a large company, and often gets lumped in with other “Loyalty” providers which are generally rather low quality. Rippl should in theory provide a platform for CDLX to cross sell to advertisers that are natural clients.

As of now I don’t assign any sort of value to Rippl, we shall simply have to wait and see how it performs.

Next up - Q3

Q3 seems to be going rather well. I would guess we come in around the high point of guidance. This would translate to about 16% YoY growth as we are now beginning to lap SBUX related comp weakness. At that point we’re starting to get into operating cash flow break even, and clearly cash flow positive in Q4.

While 16% is by no means a home run, it gets the job done given the current market environment. We’d start seeing some positive margin inflection given the incremental nature of the business model, and hopefully see better growth into Q4 and 2024 as the new UI is launched across remaining platforms and new partners are signed.

No guarantees on any of this of course, but that seems to be how things are going. The goal here isn’t to predict quarter to quarter performance per se, but simply check if developments are lining up with thesis.

Lastly - An intriguing announcement

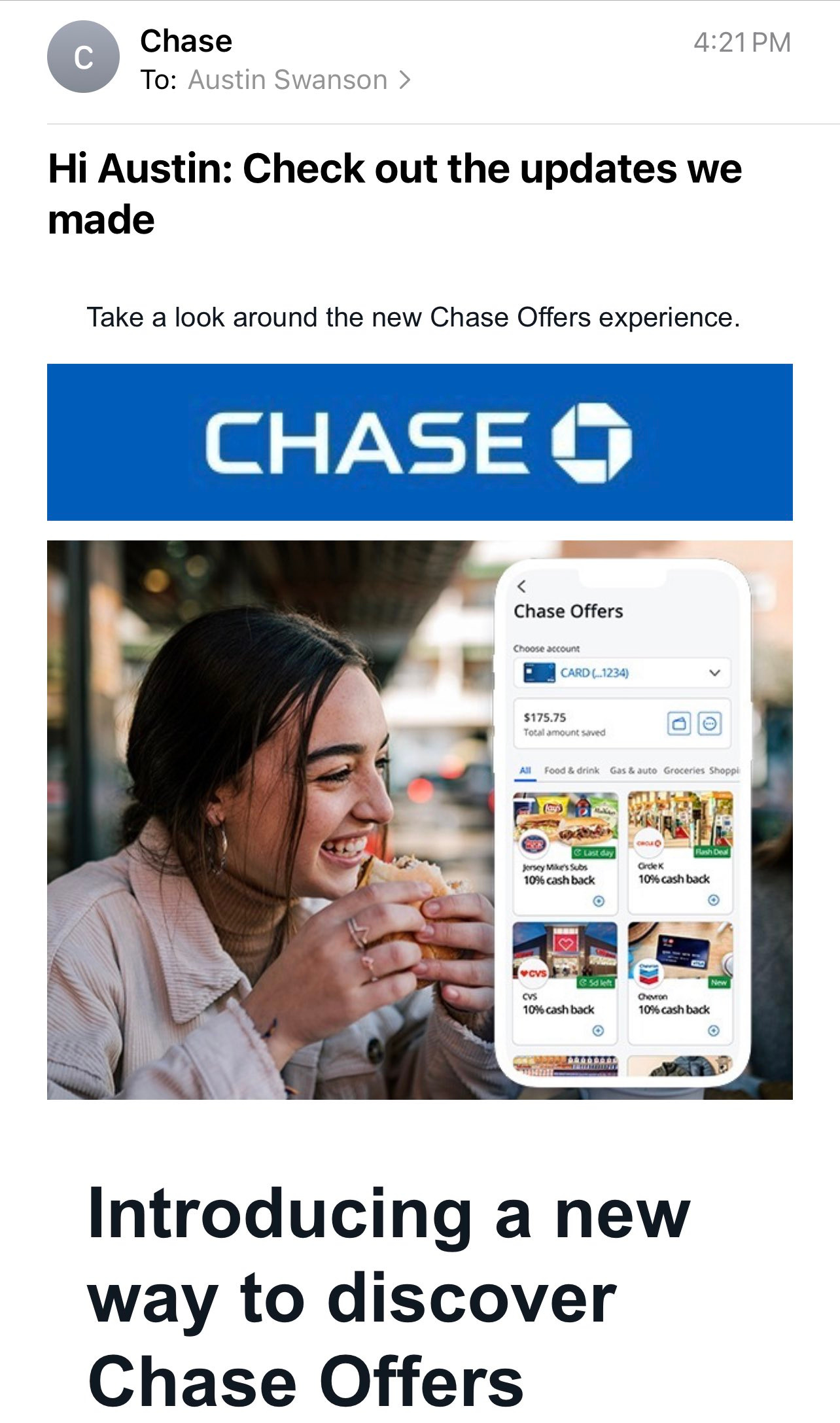

If you have a Chase account or follow Austin Swanson on Twitter (highly reccomend), you may have gotten the following email recently

As you may recall, a very key part of my thesis was that the new UI would enable bank partners to lean in on advertising the CDLX platform to consumers. The issue with CDLX tends to be customer awareness, as I have heard stickiness is decent once users actually engage, they just don’t naturally think of their bank as a shopping platform.

There is a clear incentive for banks to become shopping platforms, and the new CDLX UI makes it actually attractive to advertise (a cute girl eating a burger looking at vibrant offers vs a bunch of logos you can’t see).

The fact Chase has made the step to start formally pushing CDLX is a large plus. Not only is it further indication that Chase seems to be well invested into this type of platform, which speaks positively towards CDLX’s efforts in landing and retaining clients, but it can cause significant revenue impact. CDLX has long stated that the #1 determinant of CDLX success with a partner is said partners willingness to promote the product and work with CDLX. Chase seems to clearly be doing both, and represents something like 40-50% of revenue. Again there is no certainty this amounts to anything, and I am cautiously optimistic pending further promotion by Chase, but such activities and lead to drastic revenue shifts rather quickly.

Overall:

I still remain quite positive on CDLX. I toy with the idea of allocating ~100% to it. With my time spent away from the day to day tracking of others portfolios, I lean further towards concentration in highly asymmetric bets at opportune times. I believe CDLX matches that profile quite well. We’ll simply have to see how things go, but I am currently quite excited to see how the end the year.

Fin:

This week I plan to drop 2 articles - one earlier in the week related to more process/philosophy stuff. Feel free to skip. One later in the week focused on a restaurant tech company I find interesting. Across the board valuations seem rather fair compared to last year, so don’t expect any full fledged investment theses, but hopefully a useful highlight on an interesting business that fits within a secular tailwind of tech adoption.

Cheers.

I can confirm that Karim's sale was due to taxes and zero cash went into his pockets. The footnotes on his form 4 say: "Shares sold to satisfy withholding tax obligations upon the delivery of shares of common stock for restricted stock units that vested on September 1, 2023."

So he got a very large stock award when he was hired in Sep'22. That award of 1.35M shares vests annually in four equal installements each September through 2026. So he had 336K shares vest on 9/1 and a week later "sold" 167K shares - but really these shares were withheld as one might have taxes withheld from their paycheck. That's a withholding rate of ~50% which is high, but he's probably in a very high tax bracket (federal and state) and the disclosure was quite explicit on the "sale" being entirely a withholding.

And (not to get too in the weeds here), many companies choose to use a different coding on their form 4s such that withholdings do not show up on form 4s as sales at all but rather as transfers. But it's not uncommon for these transactions to be coded as a sale, and that's what CDLX has done here.

Confirmed: The reason for Karim's sale is taxes