$CDLX and $CVNA Updates, some philosophy, and some go forward

Intro:

It’s been awhile since my last update. Been working on some projects, mostly non-finance related. Volunteering at a friends coding summer camp, doing some travelling, my own coding, etc.

While this year has gone quite well there hasn’t been much urgency for me to dive into research on new names. Will explore more below but still find CVNA and particularly CDLX quite exciting to the point of remaining “Best Ideas”. Not going to force myself to churn the portfolio.

That said, wrapped up many of those other projects and getting back to the equity research side. In this article I’ll explore some updates on CVNA and CDLX, some general investing philosophy, as well as outline future steps for the blog. Hope it helps and as always feel free to subscribe, free or premium, as you wish.

$CVNA: Going OK.

CVNA has worked out quite well this year both in terms of stock appreciation and business results. First we can discuss the stock.

At the time of writing CVNA stock is up 788% YTD to $41. It hit highs of like +1200% YTD around $60 immediately post earnings but has traced back a bit.

Personally I’ve trimmed some. CVNA currently represents about 15% of my PA and 18% of my managed account. This is down from ~50% PA and ~30% in the managed account previously. The basic reasoning is that unfortunately the easy money with CVNA is likely over.

Essentially at $4 the company was priced for bankruptcy. My view was that was not going to happen. They were still selling cars, still buying inventory, still investing in integrating ADESA, the liquidity math was fine, etc. I had 100% conviction in no short term bankruptcy risk and that’s all that was really needed at that price. I had no issue significantly adding to a position that was drastically undervalued on a completely incorrect thesis.

Currently one will have to believe that CVNA can consistently grow numbers over time to make the stock work. The short term bankruptcy risk has essentially been eliminated by a mix of the debt restructuring and significant EBITDA inflection. While I do believe they can grow units and improve economics over time, it isn’t a 100% conviction type of deal, so lower concentration seemed prudent. That’s the portfolio management logic.

On the business side, things have gone exceptionally well. Units are currently on track to grow QoQ for the first time since Q2 2022 (per

) , which is particularly impressive given seasonality and improved monetization. GPU’s have exploded due to numerous factors, including delivery fees, shipping fees, improved customer acquisitions, better wholesale monetization, and ADESA integrations and efficiencies. All of this worked in theory a year ago, so seeing it proved out after the market insisted it was impossible is a relief.While some may note loan backlogs or inventory adjustments as inflating GPU, irrespective of those CVNA is simply operating far more efficiently than they ever have before, and growing units while doing so. I wouldn’t be surprised if they give some GPU back in terms of per unit numbers while they get back to growing units, with some leading data indicators they’re getting back into markets they turned off earlier this year, but overall a fantastic increase in gross profit dollars that I expect will only improve sequentially.

Some examples:

Wholesale volumes will likely be up 10-20% in Q3 given increased inventory acquisition - a natural result of not being overstocked going into the quarter.

A further result of increased acquisition is better fixed cost spreads - this will be a benefit in Q3 and continue into Q4

Any further growth would only improve the above factors as it would likely require some inventory build

ADESA facilities and new IRC’s continue to ramp, providing better localized economics for said markets. California for example with the Riverside ADESA facility and Rocklin IRC can alone lead to $50-$100 better GPU than the old 3P recon or shipping from AZ/UT. ADESA provided key coverage in the west and north east coasts that is still being realized.

On the flip side, vehicle prices appear to be declining in Q3 vs appreciating in Q2, and growth will naturally put some pressure on GPU if it’s increasing mix in less efficient markets. Regardless, the long term trend is CVNA can likely sustain $4500+ of GPU while growing the business with incremental margins >$3000 per vehicle.

So hypothetically if we assume 500k units by 2025, we could be seeing $1b of EBITDA with plenty of growth runway. Obviously there’s lots of variability here, hence my smaller position size, but I believe the model is quite proved out at this point. Given the lack of near term liquidity risk, they have plenty of time to figure it out.

Thus going forward with CVNA will largely just be monitoring alt data for volumes to try and gauge how big this can get and provide color on GPU potential. Less game theory on bond holders and such. I’ll still post updates, but likely won’t be doing super long articles every other month on news drops. Congrats to all who had gains and as always feel free to reach out.

$CDLX: Best Idea?

First off the portfolio management. CDLX is currently 53% of my PA and 36% of my managed account. I rolled CVNA proceeds into CDLX and my most recent purchase was 8/11/2023. This level of concentration is not one I would recommend to most and I’m doing so as I strongly believe CDLX is both drastically undervalued and absolutely capable of proving that. I believe the upside is 5x+ at a rather high probability despite already being up 130% YTD. It is the most compelling idea I have come across this year and continues to be as such.

Why?

Earlier this year CDLX largely resolved the Bridg earnout dispute. The end result effectively eliminated all cash needs until the 2025 debt is due. Great news and stock rocketed, etc.

CDLX is in a similar boat to CVNA where the “special sit” aspect has largely played out. There’s still some minor kerfuffle with the earnouts that may end up positive for them, but I doubt it’s material. The key question is simply can they grow and what the economics look like.

First on economics - there really isn’t any incremental cost to serving an ad or getting a new MAU. One can think of CDLX revenue vaguely as a monetization multiple on the number of engaged users. More users means more money, more ads mean more money, neither of which costs any money. The MAU’s are already captive within the bank platforms and the AWS cost of loading an ad is measured in fractions of a cent.

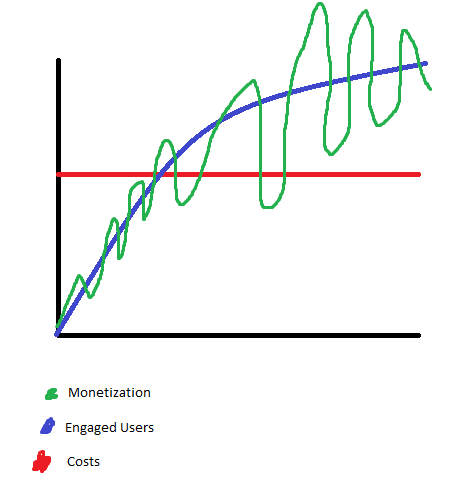

Thus we’re left with a scenario vaguely resembling the following graph (Paint for effect)

Effectively, the number of engaged users is generally increasing. We don’t have exact data on this, but it’s sort of a natural fact of the business as otherwise it wouldn’t have grown so much. How sticky users are is a key question that perhaps I’m wrong on, but I doubt churn is significant currently and re-engagement is always possible given locked in platform. The monetization variable has been painful in recent quarters following the departure of SBUX. I doubt the loss of SBUX led to lower overall users, but likely removed a key monetization lever that got users engaged with the platform for a frequent purchase applicable to a vast majority of the population. CDLX was actually able to grow revenue in Q2 YoY despite the painful SBUX comp and poor macro, likely a result of better monetization from other brands, better offer constructs, and naturally increasing users.

We’re currently at a floor for CDLX cost, which means for business performance to improve we likely need an improvement in our monetization or engaged users variables. Hence the development of the new UI and product focus from Karim, as well as potential partners such as a UK Fintech, AmEx, and others.

On the engaged users side - you’d technically have to break that up into both “engagement” and “user count”. My general hypothesis is that user count is rather predictable, it will probably grow a few tens of millions over the coming years, with some upside optionality from large partners/international expansion. The engagement side is more interesting. My guess is the new offer UI combined with launches of higher frequency product level offers will increase engagement dramatically. Some data from Alternative Alpha shows offer click throughs up ~20% MoM in July following the new UI launch, with strength continuing in to August. While turning that number into revenue isn’t 1:1, it’s a significant improvement and only live on Chase! If Chase ends up actually seeing engagement increase 30-50% consistently, that implies probably 30-50% more revenue over time if launched at similar success across all banks. Given incremental margins of ~50% gross profit with minimal SG&A, such lift would likely be $50m+ of FCF generation.

And that’s before monetization improvements! As part of the new ad server, if users are more engaged, then perhaps more advertisers can be drawn into the platform. The more applicable offers are and the more there are, the higher # of offers would be activated by each engaged user. Say CDLX has 40 clients currently running campaigns - maybe that increases to 80 and leads to 50% more relevant offers and thus redemptions? That’s a 50% revenue uplift. I find this likely as if users are more engaged, it creates more volume for advertisers to put offers against, increasing the value of the platform.

Both of these factors also feed into each other - the more relevant offers are, perhaps user engagement increases, which gets more advertiser volume, etc. A base case of $50m of FCF generation in 2-3 years makes the stock work even with the debt, so any additional benefits are pure upside, and seem quite likely.

How does the math mesh with the theory?

In Q2 2023 CDLX revenue was up 2%. Hardly sexy numbers. The biggest difference YoY I would imagine is the “monetization” variable as I dubbed it. SBUX was ~20% of revenue in Q2 of last year, so that 2% is more like a 22% growth rate for all advertisers that aren’t SBUX. Thus if we assume SBUX was a one-off, the core YoY monetization growth is probably around 20%. This is before any user engagement uplift. If we assume that is the case going forward, then with 20% increased offer click through (engagement) we’d have ~44% growth (ex-Bridg and ex-SBUX). Given the UK business is probably down a couple million YoY, Bridg is flattish, and SBUX was a headwind in Q3 last year, we’d be talking maybe 25% expected growth in Q3 2023, or $90m of revs. Obviously the guide is much lower, but self-admittedly from them conservative. Macro is also unfortunately a headwind. Either way, if we call it ~$85m revenue to match the theory - I believe that is totally possible in Q3. If that number is posted, I’d believe it cements the theory.

Now unfortunately and obviously I don’t have CDLX internal data metrics, nor would they be possible to get at this time. It’s possible the way I’m thinking about this is wrong and there isn’t actually a multiplicative and positive feedback loop with advertisers/user engagement. It’s possible users don’t actually care about the new UI and the spikes in click throughs are temporary. It’s possible advertisers don’t care even with higher volumes possible. It’s possible another high monetization advertiser leaves and it’s a perpetual treadmill. If any of that happens maybe the 2025 refi is difficult.

My general thesis is underpinned by the fact that JPM wants this program to succeed. I believe this can be seen with Dimon’s letters highlighting the need to digitalize and personalize banking. I believe this can be seen with JPM giving CDLX a higher rev share, and I believe it can be seen with JPM opting to the new ad server as the largest and most tech forward bank partner. Thus maybe users don’t care as much as I think, but there’s a JPM awareness campaign. Maybe advertisers don’t care as much as I think, but JPM leans heavily into the offering with their own deal sourcing and proves the model (as they have been doing to some extent). Etc. Lots of optionality when your biggest customer is on your side.

Additionally, I believe Karim is well equipped to execute. Tech still isn’t perfect but has improved significantly. There have been more product rollouts in the last quarter than last 2 years of Lynne’s tenure. There are large potential bank partners currently in talks. I would be surprised if execution was an issue from here.

So to summarize as it may be hard to follow: CDLX is trading at maybe 10x what I view as easily achievable EBITDA in 2025, while growing at least 10-15% a year with potential for 30%+ growth rates on >$100m of EBITDA. The management seems competent, the secular tailwinds are in place, and all that’s left is testing the hypothesis, which if correct could imply an IRR well over 100%.

Not bad, hence 53%.

Why are you so arrogant/ignorant putting 53% in one position? (Some philosophy)

In general, I hold the hypothesis that diversification of an individual stock portfolio is a total waste of time and effort. There are a few underlying assumptions required:

(As a note, when I say diversification I mean in terms of “ideas” and not always “positions”. It’s a subtle but important distinction.)

Markets are generally very efficient. I’d imagine this is rather obvious given the famous lack of consistent market outperformance from funds/investors.

Markets are not strictly efficient, but almost exclusively see opportunities when information certainty is low.

This may be controversial, but say we have 100,000 people calculating the EV of a coinflip for $1. They’ll probably settle dead on 50 cents (maybe a touch lower for TVM/Opportunity cost). Now how much would you pay to participate in a coinflip where the payoff is unknown? No clue! Thus it follows that the more unknown a situation is, the harder it is to value.

From the above, the two ways to generate alpha are information edge or judgement edge.

If you could bound the payoffs in the unknown example at say $100 and $200 - you’d be willing to pay up to $75 or so. Maybe you figure out a way to do this that other people don’t know, hence you have an information edge.

It is communicated that the payoff is $100t. Everyone else believes this, you do not as who will pay out $100t for a coin flip. Everyone else bets their life savings and loses it all. You have a judgement edge.

In essence this could be viewed as another form of information edge. I generally use “judgement edge” for scenarios where information is either disregarded or not necessarily objective in consequence

The 80/20 rule is more like 95/5 rule in investing

Not only does this mean that the last 5% takes a lot of effort/time/ability - it means it’s very easy to be optically knowledgeable.

A consequence is that it is very very difficult to have that last 5% of knowledge, which is often required in a very efficient market. Sometimes even impossible in a requisite time period before a security is re-priced.

When I saw knowledge here - this can actually be sourced from a variety of things. It can be from traditional “work” and “analysis”. It can be from life experience. It can be from whatever works. As an example - some “unsophisticated” tech employee investors all inned Apple or Oracle in the 80’s/90’s and made fortunes. Life experience can sometimes fill in for work and finding an opportunity that “clicks” is paramount.

Information will always be imperfect for any business

This provides opportunity if you are able to find less imperfect information and also provides an explanation for why markets can be wildly wrong. CVNA for example say a slew of totally incorrect and imperfect information - using alt data and differentiated analysis, one could tell said info was wrong.

The vast majority of people have no idea what they are doing, thus finding competent stewards of capital is rare and should be cherished.

Hopefully the above make sense. In simple terms, it’s basically that markets are more efficient than people think, harder to get an edge in than people think, and many simply don’t know what they don’t know. Concentration helps in numerous respects. It leads to more time to get an edge, more time to figure out what you don’t know, and more time to enact novel information edge.

I find making it mathematical is helpful, so consider the following. A simple way to think about it - would you rather play 100 tables of poker in a day with 1/100th of your net worth each, or 5 tables of poker in a day with 20% of your net worth each?

If you choose 100 tables, you don’t have time to gauge the other players at the table (mgmt/fellow shareholders). You don’t have much time to analyze your hand and what to do with it (the company and its financials). You will likely even lose track of what can come out of the deck (future news flow). It’s a great angle if you are aiming for wealth preservation by just playing a risk averse style. But the 5 table strategy opens you up for higher focus and differentiation, as well as more attention to capture the rare blunder from others.

Hence the recommendation - if you would like to preserve wealth - diversify. At which point is 100 tables different than 2000? At that point couldn’t you just create an algorithm to handle it for you? (an index if we exit the metaphor).

If you would like to build wealth - concentrate.

This seems self evidently true. Bezos did not get rich from an equal distribution of his time in AMZN and 99 other companies. Same with Gates, same with the Walton’s, Zuckerberg, etc. Musk is a serial CEO and even he only has a handful under his belt. Even Buffett is basically the AAPL guy at this point. Funny how many admire him while capping positions at 5-15% of a fund

Of course from an outside perspective you do not have the direct control that those mentioned above had. It also means you need to work harder to get even somewhat close to the information they have at their finger tips, hence point 6 above.

Good stewards of capital are generational talent. Out performing the market in the business side is just as hard or harder than the finance side. I promise Ernie Garcia did not have an easy job, especially over the past 12 months. The business is ultimately going to be a culmination of top down decisions, so getting comfortable with the top is paramount. I’ll explore how I do so in a later article, but it is not an “easy and quick” thing.

So to summarize - I view concentration as the best course of action if one wishes to actively manage their own capital. I also believe most simply should not. (Perhaps even myself? TBD).

So conceptually having high % is covered, now why CDLX and why 53%?

Why CDLX/CVNA - Generally for me to invest at size in something, I want to have novel and high signal analysis proving a key thesis point that is underappreciated by the market. CVNA for example I could clearly tell was investing in the ADESA rollout and restructuring the company to be more efficient and eventually profitable. Proprietary alternative data proved shifts in logistics routes and reconditioning, as well as stable demand levels and explainable unit decreases due to monetization efficiencies. This combined with standard analysis allowed for better game theory to be played around bankruptcy concerns which lead to significant alpha. In essence, an informational advantage that was leveraged into a judgement advantage. Some would and still do call that luck, I call it very good work, however I agree I am unsure how repeatable it is both in setup and complementary skill set applicability.

With CDLX - Somewhat proprietary alt data on consumer engagement, combined with good fundamental analysis and a better than average understanding of ad tech and consumer interactions with UI/UX will hopefully create significant alpha. It is possible I’m missing something or wrong to be clear. So why size it if I can be wrong?

My current answer is that because opportunities such as this are exceptionally rare and if I’m wrong it should be quite obvious. Unfortunately sometimes stocks move a lot in the negative direction before you are proved wrong, so there is significant risk. Let’s think about if it’s right though for a second:

Under a framework where good opportunities are exceptionally rare, let’s do some basic math. Say you have a portfolio that does 10% a year on average. You find a position you are 90% sure will double in a year. If you size it at 50%, next year you might return 55%! If you size it at 5%, next year you might return 15%.

The difference?

Call it 4 years of 10% and 1 year of 15% versus 4 years of 10% and 1 year of 55%.

Option 1 does 11% a year.

Option 2 does 18% a year.

So if you size it at 5%, you are effectively wasting your time. If we assume the index is doing 10% you probably aren’t even breakeven post tax and expenses, and definitely not post fees. Thus you either need to be consistently outperforming the market with your dozens of stock picks - which would be impressive given most stocks underperform the market - or win drastically when you do win.

Ways to win drastically are either buy significant skew, or concentrate.

I try to do both.

Margin of safety? You get that by buying roadkill and just not being wrong.

CDLX for example could it trade back down to single digits? Sure. I won’t blow up by any means if it goes down 20%. Even if it goes down 50% I’ll be plenty fine. All that matters is if it does go down, don’t be wrong, and if wrong, sell immediately. If my ability to judge skew is somewhere in the ballpark of what I believe, and my hit rate can be as high as I believe it can, then a large loser will be more than made up for. If not, I should simply buy the index.

Hopefully that makes a lick of sense. I’m currently sitting here with a covid fever so trying my best. It will likely come across as totally insane/ignorant to many professional investors. The vast majority of professional investors also underperform indices with a rather formulaic approach and try to convince you of their ability to distinguish differentiated businesses while running stock standard commodity models themselves. A key point is that I have no idea if I’m good enough to consistently outperform post fee/post tax. As of now I could likely liquidate the account I manage and maintain trailing O/P for a few years just sitting in cash, but replicability is the name of the game. It’s possible I had a skillset/mindset that was simply very well suited to the last 12 months and not generally. Won’t know for sure until we see how it goes.

On that note.

Go forward: This Blog

I have an idea I’d like to try where I basically do a brief article each week on a company of my choosing. The purpose is to get my eyes across new businesses in case I run face first into some liquidity as well as open up a dialogue and hopefully share information. I’ve found the outreach I’ve gotten very high quality and exceptionally helpful with analysis, so feel free to reach out about anything.

The first will likely be BLND - my goal is to give an overview on the business, my quick thoughts, and what can differentiate the thesis.

Cheers and hope this was useful or at least interesting.

Great article Indra. Another very good example of differentiated judgement that makes total sense.

Take care of yourself to get past by COVID soon.

Good health, take care! 😊

Kudos that you have the humility that the past 12 months have been especially rewarding for CDLX and CVNA.

Also, "don't be wrong" is the best margin of error.