$CVNA - Deconstructing the Hindenburg Report

Preface:

Howdy readers, your resident CVNA shareholder here. For those who may be unfamiliar, I have frequently written about CVNA on this blog and my Twitter. I also provide alternative data on CVNA, with free access to a Q4 summary coming soon, here.

Given the following of Hindenburg and numerous inquiries, I figured it best to do a quick article discussing their recent short report on CVNA, which you can find here (website) or here (Twitter thread). I’ll break down the report here, but feel free to give it your own read.

For those unfamiliar, I’ve done breakdowns of bearish sell-side notes and short reports on CVNA previously, they were a lot more common back in 2022/early 2023. Typically such write ups misunderstand or misconstrue numerous aspects of the business, which I try to explain in my analysis.

In this case, I believe the report is largely Hindenburg significantly misconstruing facts and being intentionally misleading with select commentary removed of context. The basis of the short is likely the underperformance of risk assets over the past month providing an opportunity to spike in a headline for a quick profit. In short, they are leveraging their reputation to mislead market participants for their own gain.

Intro:

The title of the Hindenburg report is “Carvana: A Father-Son Accounting Grift For The Ages”

Typical bear arguments on CVNA have ranged in scope from being business related, to macro, accounting, etc. The Hindenburg report touches on numerous aspects, but the focus is clearly an implication that the accounting is not to be trusted. The purpose of this lens is to create skepticism of any CVNA reported metrics, regardless of the existence of evidence against those metrics. For this route to be successful, Hindenburg must paint a picture that CVNA’s disclosures are untrustworthy and paint doubt the reported KPI’s such as unit sales/GPU’s are reasonable.

So let’s explore their attempts.

Point 1:

“However, our research, including extensive document review and 49 interviews with industry experts, former Carvana employees, competitors and related parties of the company, undertaken over the course of 4 months, shows $CVNA's turnaround is a mirage.”

For those not familiar with professional equity research, this is really nothing special. “Industry experts” in this case are also not particularly noteworthy typically. There are a plethora of interviews on Tegus/AlphaSense/etc where car industry “experts” said CVNA would never work, consumers would never buy cars without seeing them, etc. Even when doing the calls yourself, it’s quite hard to tell if someone actually knows what they are talking about or are intentionally being misleading.

Point 2:

“Even before considering our findings, $CVNA is exorbitantly valued, trading at an 845% higher sales multiple relative to online car peers CarMax & AutoNation, and a 754% forward earnings premium.

CVNA will of course trade at a premium, as it is growing ~54% YoY as of Q4 2024 while KMX is lucky to grow single digits. The used car business is very fixed cost heavy, so growth leads to rapid earnings growth as we have seen with CVNA EBITDA over the last 24 months.

Point 3:

Carvana’s business already faces major headwinds. Used vehicle prices have declined 20.3% in the past 3 years, according to the Manheim Price Index.

Anyone who says anything like this in reference to used car companies has no idea what they are talking about.

The Manheim index measures wholesale prices of vehicles. Margin is determined by retail prices less wholesale price. Wholesale price going down, all else equal, is good for used car retailers.

The mistake people make is two-fold

They assume used vehicle retailers make a % margin on sales instead of targeting a $ margin

They assume retail and wholesale prices sync (or just don’t understand the Manheim index is wholesale).

In reality the prices CVNA can charge have been at a meaningful premium to wholesale values, actually having increased while the Manheim index decreased.

This has actually been a major BOON, not a headwind as Hindenburg describes. Either they don’t know what they are talking about, or are willfully misleading investors with flawed and limited analysis about the Manheim index.

Point 4:

Previously, Carvana CEO Ernie Garcia III’s father, Ernest Garcia II, sold $3.6 billion in stock between August 2020 and August 2021. In the year after he stopped selling, Carvana’s stock plunged 99% and faced bankruptcy concerns shortly thereafter.

The point of sharing this is to say that EG2 front ran poor business performance by selling down shares. In reality he sold a portion of his ownings, lost paper billions on the way down, and bought more shares on the way down.

The stock being down 99% was also largely due to macro-economic and geopolitical factors that were relatively unexpected to most all market participants. It’s not as if EG2 knew interest rates would soar as consumer confidence plunged and inflation spiked due to covid remnants.

Hindenburg is trying to say this sale into a later stock drop was in some way sleazy. In reality the Garcia’s are probably one of the rare good capital allocators in the market.

Point 5:

With $CVNA shares up ~42x, father Ernest Garcia II has sold another $1.4 billion in Carvana stock.

The idea is to make the run-up in 2023 and 2024 suspect given the sales of EG2. Again, he owns multiple billions of CVNA stock, and is taking out additional cash he put into the business over time. Those sales in 2024 also ranged from $130 to $200 and were repeatedly done going into record breaking quarters. If one had exited on his large stock sales, they would have missed 50-100% additional upside.

Point 6:

Carvana has relied on a purchase commitment agreement with Ally Financial, to which it sold $3.6 billion of vehicle loans in 2023, ~60% of its total originations. Carvana has told investors for at least 6 years that it is seeking to diversify outside of its relationship with Ally, but thus far has not announced new financing partners.

ALLY has an agreement with CVNA to purchase loans at pre-established terms. This makes it really easy for ALLY as they don’t have to do their own underwriting/servicing/etc. If they want more exposure to auto loans, they simply buy some from CVNA. In 2022 and 2023 when ABS markets were weak, ALLY was able to easily handle the additional loan volume from CVNA. Diversifying away from ALLY is not an existential risk or necessity, and if needed the plethora of ABS transactions purchasing CVNA debt show a clear market.

The only reason CVNA would face problems is if they could not find any buyers for their loans. This would only occur in 2 scenarios

The loans are fraudulent

The debt market is frozen (2008-esque type of deal)

Point 7:

Over the last 2 years, Ally’s loan book has become increasingly concentrated, with $CVNA loans rising from 5% of its consumer auto portfolio to 8.4%. In Sept. 2024, Ally’s stock fell ~20% after warning “on the retail auto side, our credit challenges have intensified”.

Sales to Ally have scaled back year to date through Sept. 2024. Carvana sold $2.15 billion of loans to Ally in the period (~$2.86 billion annualized), only 35% of total originations. This compares to $3.6 billion in loans or 60% of total originations in 2023.

Couple things.

First, loans sales to ALLY have decreased in 2024 as ALLY was being used as a stop-gap in 2022 and 2023 due to light ABS activity. This has nothing to do with CVNA’s underwriting quality nor ALLY’s appetite. CVNA has actually made a higher profit on their loan sales this year than in 2022/2023 as those years marked unusually low appetite for loan buying.

Additionally, ALLY’s comments were related to 2022 vintage loans. Even if we assume CVNA is the sole source of underperformance (it isn’t), CVNA tightened underwriting standards throughout 2022 and 2023. There’s really no indication ALLY has an issue with CVNA’s auto portfolio.

Point 8:

With Ally pulling back, a new, unnamed buyer has quietly emerged exactly when Carvana needed it. In the past two quarters, Carvana sold $800 million in loans to an “unrelated third party.” The mystery buyer made up 18.3% and 16.3% of total loan sales in Q2 and Q3 2024.

This directly contradicts the idea that the ALLY relationship is an existential threat if another buyer can pop up and take in $800m of loans in 2 quarters.

Point 9:

Lien filings reveal the buyer is likely a trust affiliated with Cerberus Capital, where Carvana Director Dan Quayle is a member of its “senior leadership team” & Chairman of Global Investments, indicating the new buyer is an undisclosed related-party, contrary to $CVNA's claims.

Cerberus Capital is a credit firm with tens of billions of AUM. I would highly doubt Dan Quayle is intentionally sabotaging his firm to make a few million of some CVNA stock.

Another way to view this is that a sophisticated debt buyer is very interested in buying CVNA’s loan originations, which would indicate CVNA originations are actually in demand

Point 10:

These suspected financing games are occurring as Carvana faces major economic headwinds— 44% of loans for cars purchased since 2022 are underwater, per a recent survey from CarEdge.

CVNA has pretty much consecutively achieved improving loan purchase terms for the past 8 quarters. CVNA’s “Other GPU” is actually near all time highs despite market wide worse performance. Hindenburg tries to construe a worse debt market to mean worse CVNA performance, when the reality is that CVNA’s performance depends on their performance in relation to the market.

CVNA has historically written better debt than average, and gets increasingly rewarded for it when the general market has troubles.

Point 11:

Almost 44% of Carvana’s loans it sells in ABS deals are non-prime. Over 80% of its recent non-prime ABS deals have weighted average FICO scores in the “deep subprime” range, the riskiest levels, per Morningstar data.

ABS math 101

If risk is higher, pay less. That is the fundamental idea behind debt purchases. For example, say I have a friend who wants to borrow $100. I think there’s a 50% chance he just never talks to me again after. I ask my other friend to buy that obligation from me, where he would get paid back instead.

That friend would pay no more than $50. Now let’s package that up 1 million times, that is the basic math of an ABS deal.

Loss expectations are baked into the asset pricing. The interest rates are so high that even a good chunk of loans don’t perform, it doesn’t matter. Loss expectations for subprime ABS deals can be near 20% and it’s totally fine, they can still pay out very well. CVNA loss expectations have moved higher from 2021, as have basically all issuers, but so have interest rates, so the net effect is CVNA and their debt buyers making very good money.

Point 12:

Carvana’s toxic loan book is a result of lax underwriting standards. “We actually approved 100% of the applicants”— interview with a former Carvana director describing virtually non-existent underwriting standards.

This is something that sounds crazy until you look into it.

In reality CVNA requires very hefty interest rates and down payments for truly terrible credit buyers. The idea being that if one can put together a large portion of the vehicles value for the down payment, they can possibly make the payments even with poor credit quality.

This model isn’t unique to CVNA, CACC is another multi-billion dollar business built around approving those with shit credit. The result is better performance than peers as on average, those super high interest rates and down payment requirements make those customers profitable.

Point 13:

Carvana has issued over $15.4 billion of asset-backed securities (ABS), which it retains partial interest in on its balance sheet. 60-day delinquencies across its supposedly “prime” borrowers are over 4x industry averages.

I’d love to see some evidence of CVNA prime delinquencies being 4x industry average. The best idea I have is that Hindenburg is comparing vs new car securitizations which are an entirely different profile. Pulling up a random KMX securitization and CVNA securitization from 2022 I see a 5.3% delinquency rate for CVNA and 5.1% delinquency rate for KMX, effectively in line. The KMX ABS also has 2.2% realized losses vs 2.1% for CVNA, as delinquencies converting to actual losses is reliant on numerous factors.

The idea that CVNA underwriting is poor compared to competitors is simply un-true, they repeatedly outperform which is why CVNA makes so much money on loan underwriting.

Point 14:

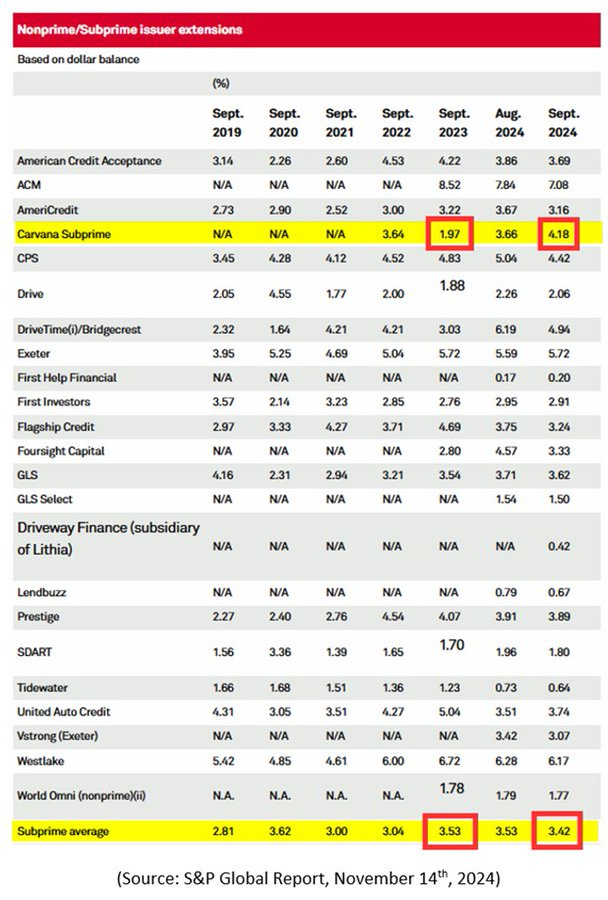

Carvana's subprime loans had the highest increase in borrower "extensions" of any subprime auto issuer, a major sign of stress, per S&P data. Carvana’s extensions more than doubled this year, while most peers saw declines.

The associated picture from Hindenburg here tells the story. CVNA essentially just wasn’t using extensions previously, now they are. Could just as easily compare vs Sept 2022 where CVNA’s trend is in line with peers.

Point 15:

For example, Carvana’s increase in borrower extensions is enabled by its loan servicer, an affiliate of private car dealership DriveTime, run by Carvana’s CEO’s father. The company seems to be avoiding reporting higher delinquencies by granting loan extensions instead.

The purpose of extensions is to reduce delinquencies yes, there is a reason so many firms do them. All that really matters at the end of the day is realized loss rates, where CVNA performs in-line or better than industry peers.

CVNA ABS deals have seen increasingly better spreads since 2022 due to the fact their packages consistently perform well. ALLY, Cerberus, and a plethora of public buyers consistently show demand for their debt. These are numerous institutions much more qualified to assess paper quality than Hindenburg. They are also institutions with a much higher vested interest in doing so, as they are actually buying the paper instead of merely critiquing it. No ABS buyer is unfamiliar with extensions, yet they continue to pay a premium for CVNA paper.

Point 16:

In another example, in 2023, $145 million of “other revenue” or ~8.4% of gross profit came from related parties. This included $138 million of commissions and profit-share from DriveTime.

Carvana appears to be dumping unreported costs of extended warranties onto related-party DriveTime, resulting in artificially inflated revenue and profitability. We estimate Carvana reports ~58% more warranty income per sale due to the relationship.

This assumption is entirely based on Hindenburg arbitrarily assuming a 30% warranty attach rate for CVNA vs 60% for KMX. There is no indication this is true, or justification that it is true. They are also purely speculating on the terms of the agreement.

While entirely possible Drivetime is arbitrarily taking a loss to boost CVNA profitability, the net effect is extremely small. Even if we assume they are overstating warranty income by 50%, the “real” number would be ~$95 million, or a 3% hit to gross profit. This isn’t really material when gross profit has more than doubled since 2022.

Point 17:

Additionally, instead of marking down inventory, Carvana can offload cars to related-party DriveTime at a premium. Over the last three fiscal years, Carvana has generated $105 million revenue from selling cars wholesale to DriveTime.

Over the last 3 fiscal years CVNA has ~$25 billion of revenue. Let’s pretend Drivetime is arbitrarily buying cars at a 100% premium and thus gifting CVNA $50 million. That would be .2% of revenue. The related party transactions are mostly just a convenience. You and your dad own used car businesses, exchanging inventory occasionally, exchanging services occasionally, leasing reconditioning space, it all just makes sense. If anything, a huge benefit to CVNA early on was the relationship with Drivetime which allowed them to lease space at favorable rates while sub-scale. These days that relationship is a very small fraction of CVNA revenue and expenses, but it highlights how hard it is to spin up a competitor when CVNA barely succeeded with help.

Others such as Shift and Vroom simply died.

Point 18:

A former Carvana director responsible for wholesale inventory told us: “[Selling cars to DriveTime is] a lever that's not talked about. It's kind of like Fight Club… there's certain things we don't talk about, and we don't talk about DriveTime.”

If an employee wouldn’t shut up about .6% of revenue I’d tell them to fuck off as well.

Hindenburg is really stretching if the best case they have for accounting fuckery is guessing that related party transactions are egregiously over performant when they make up LSD % of revenue and gross profit.

Point 19:

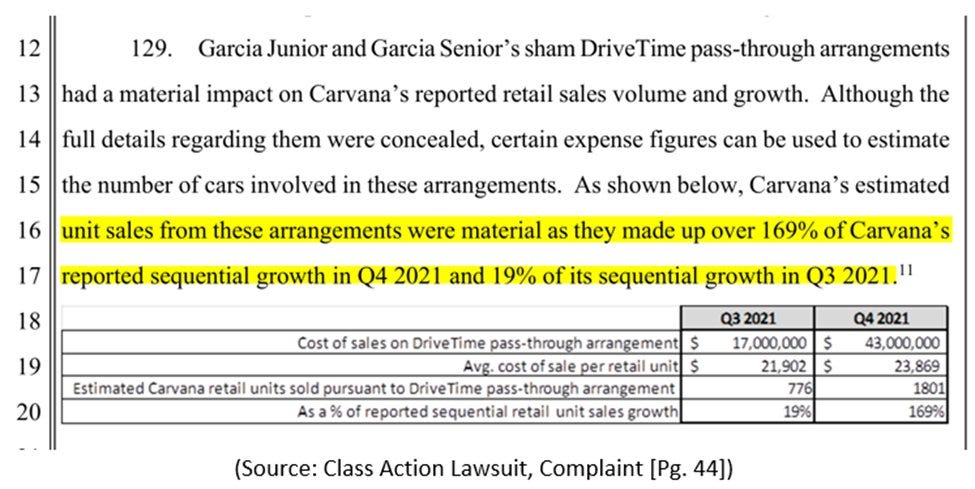

Carvana engaged in “sham” deals with DriveTime, along with numerous other improprieties, per allegations in a 2024, 332-page amended class action lawsuit brought by two pension funds, which included information from 12 confidential witnesses.

Q4 is seasonally weaker than Q3 of course given the holidays. Also as you may recall, Q3 2021 was euphoria, Q4 2021 is when the doom started to set in macro wise. 1000-2000 vehicles when selling 110-120k per quarter is practically irrelevant.

In the most recent periods this number is also basically $0.

From CVNA 3Q24 10-Q

The Company also recognized zero and $1 million of cost of goods sold during the three months ended September 30, 2024 and 2023, respectively, and less than $1 million and $3 million during the nine months ended September 30, 2024 and 2023, respectively.

Point 20:

These sketchy related-party dealings seem to be enabled by conflicted board members. Carvana’s “independent” audit committee has two individuals that served on the board of related-party DriveTime.

One “independent” member of the audit committee, Greg Sullivan, was previously suspended by the New York Stock Exchange after he sent money to Carvana’s CEO’s father in contravention of a prohibition order, per legal records.

Carvana’s CEO’s father previously pled guilty to felony bank fraud over allegations that he helped a company report fake income through sham transactions. SEC charges also alleged he “signed a falsified letter for [the company’s] auditors”.

Essentially Hindenburg is saying because of silly dealings by the CEO’s father 30+ years ago, the related party transactions that make up 1% of revenue are suspect.

The thing is, if you fully replaced those transactions nothing changes. The essence of CVNA’s recovery over the last 24 months has been due to drastically improving unit economics, significant growth (+55% YoY for Q4), and thus has nothing to do with subscale related party transactions.

For CVNA’s turn around to be a mirage would require Drivetime and related parties to be falsely inflating revenue to the tune of numerous billions, not MAYBE $100m annually.

Point 21:

In addition to the grab bag of related-party tricks, Carvana exhibits a litany of other accounting issues.

Carvana’s CEO has said: “We don't end up taking the credit risk over an extended period of time.” Yet Carvana’s loans held on its books have increased 50% since 2021, to $553 million in Q3 2024.

This is a very silly point. The amount originated is also up in that time frame.

Additionally, the amount of loans held is largely a timing thing. This metric spikes around depending on the timing of CVNA ABS deals. During 2023 CVNA played with that quite a bit as the ABS market was largely frozen, so holding loans for better market sentiment made sense and generated additional profits.

The whole point of utilizing the ABS market to recycle capital is to reduce credit risk and faster turns of capital. KMX has increasingly moved in this direction as well.

Point 22:

For example, on May 4th, Carvana reported Q1 2023 earnings, showing a 41% y/y decline in loan sales, swinging to negative adjusted EBITDA amidst bankruptcy concerns. CEO Ernie Garcia blamed the delayed loan sales on “uncertainties” in the securitization market.

Against this backdrop, with the stock price depressed, the Garcias signed an agreement to purchase $126 million in Carvana stock on July 17th, 2023.

Two days later, Carvana announced the “best quarter in company history,” featuring a massive earnings beat from re-accelerated loan sales, as well as the successful restructuring of its debt. The Garcias are up ~$427 million on those precisely-timed purchases.

For context CVNA entered May of 2023 at ~$7 and ended the month at ~$16

The stock opened May 4th at $7.10 and closed May 5th at $11.19, a 58% post earnings bump

This is quite contrary to Hindenburg alluding to the company hiding profits to purchase additional shares. The math on the loan sales was rather obvious at the time.

On July 17th the stock opened at $37.77. Following earnings it closed at $56.92, a 51% jump.

The “depressed stock price” due to “bad loan sales” was actually a quarter that saw a higher post earnings bump. If the Garcia’s instead bought $126 million at $7.10, they would be up >$2b on those purchases.

Point 23:

In Q3 2024, Carvana reported $3,497 in retail gross profit per unit, a key metric for investors to understand the profitability from the sale of retail units. Carvana inflates this key metric by ~34.5% by dumping an estimated $390 million of selling costs into SG&A annually, in stark contrast to accounting practices at competitors.

What they mean here is that CVNA records half of transportation costs in SG&A. Off the top I believe they account for inbound transportations in COGS, but outbound as SG&A (I may have it reversed, not important). This is due to vehicle delivery being atypical as most used car companies of course use physical lots.

The thing is, this has been consistent accounting since IPO, so any gains are like for like, not due to accounting trickery. It also does not change that CVNA has the best EBITDA/unit in the industry, which is agnostic of whether the charges are in SG&A or COGS.

Point 24:

In Aug '23, $CVNA told investors cost reduction measures did not impact quality. But a former reconditioning leader told us otherwise: “They did make an adjustment to the standards, but only for that segment. They call it their economy line. I don't think they talk about that.”

I’m honestly not sure the point of this throw away.

CVNA is currently growing ~55% YoY in Q4 per my data. Consumers clearly enjoy the product. We have one former employee who says that a subsection of reconditioned vehicles is held to different standards? Does that even mean quality is diminished? How? In what way?

If interviewing dozens of former employees got you solely “our economy line reconditioning changed in some undisclosed way” as your negative, that seems quite weak as a bear case.

Point 25:

Overseeing all this for 10+ years is Carvana’s mid-tier auditor, Grant Thornton, which also has/had a relationship with related-party DriveTime. “We are not doing what the market thinks. We are not looking for fraud…” – Former Grant Thornton UK CEO.

A throwaway showcase blog by Grant Thornton saying Drivetime is innovative somehow means that Drivetime and CVNA are fraudulent and Grant Thornton is complicit.

This reads like someone forgot their Lithium dose.

Point 26:

Finally, Carvana is subject to an undisclosed SEC investigation, per Disclosure Insight, a Freedom of Information Act (FOIA) intelligence firm. We think the company should clarify to the market whether it has faced SEC investigations and their status.

This point has been around since at least 2020 and likely earlier. SEC investigations happen all the time and there is no requirement to disclose something unless it is substantial or meaningful to the business. Given CVNA has not disclosed anything, odds are its not substantial.

Of course this could be wrong, but even if we assumed all the related party transactions were over valued or even purely fraudulent, CVNA would still be the most profitable and fastest growing used car retailer in the country, with the only scaled online purchasing model.

Even if Hindenburg was 100% on the money with this report, they would still be wrong.

Closing:

Hopefully this article was helpful and shed some light on any topics you may have been unfamiliar with.

My personal view is that short reports are typically heavily exaggerated, and dance around outright lies. Firms such as Hindenburg occasionally find true frauds such as Tingo Group or what have you, but by necessity must publish more reports than their are frauds to maintain relevancy. Additionally, faking tens of billions of dollars in revenue domestically is pretty hard, but nobody cares much about illiquid microcap fraud, so the incentive is to over exaggerate on large caps.

I believe Hindenburg is competent enough to know they are lying and being misleading, which I find despicable as anyone who shorted on their report may lose significant portions of their investment shorting one of the best turnaround stories in history.

I do however, thank them for the additional shares at $170. Cheers.