Prediction Markets and Finance: Finding Clarity

Yes it’s a cheesy title, sue me.

As of a bit over a week ago Clarity has become a full time thing, featuring the whole pitch deck/fundraising/etc shenanigans. New stuff is fun, I think it will do well, and getting angel checks from analysts and PM’s that read my blog is super cool (thank you!)

That said, this article isn’t to promote that work directly, simply to underline the core thesis of it. I’m of course trying to bring about the reality I see in my head and think our team has pretty good odds, but putting up a public post that can stand regardless of our success is a fun exercise. Also, for our endeavor to truly succeed will rely on the participation of many internet analysts such as yourself, so building a public vision is heavily in our best interest.

Also my portfolio is ~80% CVNA currently and they are doing exceptionally well, so not much to update on with the stock side. CDLX has been disappointing but may have some sparks of life this year. They love to inverse expectations so maybe it’ll finally pay off! If so, it will take a couple quarters for AmEx to scale, so no rush. For more info on both you can view our free data sets at https://www.clarity-markets.com/

The Future of Prediction Markets

For those unfamiliar, a prediction market is exactly what it sounds like, a market for predictions. The most popular recent example was the 2024 election cycle which saw numerous billions (USD) of volume put through popular exchanges such as Kalshi and Polymarket. These markets also had the outcome of that election effectively confirmed (>98% odds) hours before news outlets did. It was a flashy showing of the wisdom of the crowds when applied to a high stakes political outcome. Who needs pundits when we have MIT nerds with spreadsheets?

These markets have a variety of questions on them beyond politics, such as daily weather, Rotten Tomato’s scores, whether Zuckerberg will get divorced, and more. They typically monetize by taking a small portion of trades as fees, which incentivizes creating markets that are the most “memetic” and controversial, such as literally anything to do with Trump.

As an analyst at heart, this creates the obvious problem where your average user is losing money and may only engage sporadically for politics. Extracting wealth from users is absolutely a viable business model as your NFL playoff ads have certainly shown, but it means you have to keep reminding users to come give you a quick donation, as your NFL playoff ads have again certainly shown.

So if our goal is to improve user outcomes, perhaps even make them positive sum, how would we do it?

The rather obvious answer here is that the world already collectively spends tens of billions of dollars for people’s opinions via their job. Information and opinions are worth something and prediction markets are simply a collection of opinions. The Trump election for example has had some absurd implications for businesses. I can imagine the agricultural industry will look quite a bit different under Trump than it would have under Harris. Or any business exposed to the border, or Tesla and Elon, etc. The total impact of Trump over Harris will likely be tens or hundreds of billions of dollars for certain industries and companies. Prediction markets pegged Trump at a ~65% chance to win vs ~50% for many polls and pundits.

A 15% edge on an outcome with hundreds of billions on the line is INSANE.

Now of course it’s impossible to know exactly what stocks and businesses were pricing in, but if we lived in a pre-prediction market world, I’d imagine the clear course of action would be to trust the “experts”? My take is that prediction markets will increasingly emerge as sources of truth for a variety of topics. We are just beginning.

Prediction Markets and Finance

Elections aren’t the only questions of opinion that have a great deal riding on them. As many of you work in finance, you are probably aware that almost your entire work is subjective matters of opinion with potentially billions riding on the line. In fact I’d argue finance is probably the industry with the most riding on subjective opinions by far given we have active access to every public asset in the world, where prices are by definition a matter of opinion on future cash flows.

Which raises the natural question, why in the world aren’t we using collective wisdom via prediction markets for opinions relevant to equity research? Many finance professionals will express how hard it is to outperform the market, how it takes a specific mindset, years and years of experience, a ton of hard work, a ton of IQ, etc.

Then they turn around and hire a 20 something junior analyst to build a 5-10 year forward model of the AI industry.

What?

To me at least, when laid out like that, it’s rather obvious that the current method of equity research is quite silly. The majority of finance professionals spend their careers getting smacked by the market yet have the audacity to assume they can scout, train, and manage exceptional analyst talent?

The approaches to this problem are increasingly diverging into two camps.

Camp one are the multi-managers, who rigorously rank and control talent based on outcomes and spread risk broadly while buying a shit ton of SaaS. The idea being to actually try and get an edge in these highly competitive short term bets on core asset metrics. This strategy is so hard that only a few firms in the world can manage it, they spend more on tools than the net worth of the average readers family line, and returns without leverage are pathetic.

Camp two are many single managers these days, who simply wash their hands, ride the uncertainty, and are willing to eat near term analysis loss because they believe their vision of the future is directionally correct. This works for maybe 10-20% of them due to a hard to disentangle combination of skill and luck.

I think both of these have some rather clear downsides and result in billions of dollars spent on duplicitous research, analyst salaries, consultants, expert calls, alternative data, and more.

So why not aggregate research?

I think the answers to that question are actually pretty simple:

Nobody has tried it.

Asset management is inherently an egotistical profession, of course you can “do better”

The majority of the history of financial markets was in a vastly different information era where you could just research better with a bit of sweat

Imagine researching in 1950 with no internet, all by hand, no CC data, no Yipit, no Tegus, calling your broker to mail financials, etc. A random college kid these days is a Bloomberg terminal away from info parity with a $1b fund.

So given the developments of technology, I’d like to try it.

Vision:

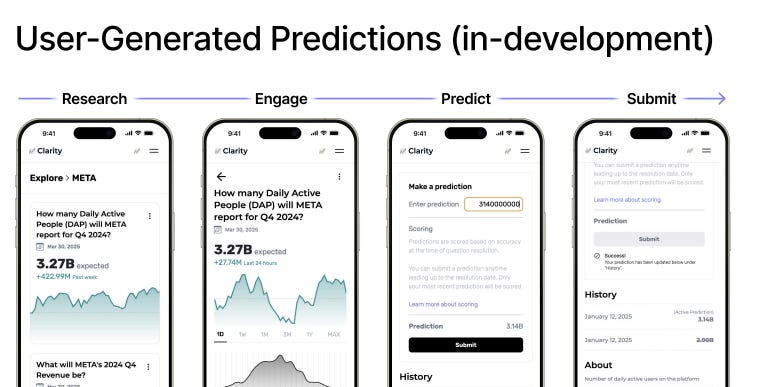

The vision here is pretty simple. A financial research prediction market.

With Clarity, our goal is in 10-15 years, if you are investing in an asset, you should be using our platform. There’s a lot of execution between here and there no doubt, but let’s skip that for the sake of brevity.

In my mind, for any asset purchase there are typically a few key drivers that are in debate by the market which drive the valuation. CVNA for example is pretty much a function of (cars sold * (gross profit per unit - SG&A per unit)) * multiple). Of course each of those have a host of embedded assumptions, but that’s the basic gist.

My view is that increasingly near term cars sold, GPU, and SG&A, will become table stakes. Data coverage such as mine is quite valuable, but in an era of AI will inevitably be perpetually recreated. CC data for example is pretty much a requirement for investing in retail names, not due to alpha, that’s long gone, but because everybody has it.

This will slowly propagate out to more and more stocks as the world gets increasingly better data access and computational power. I’m sure many of you have felt this dynamic when going into contract renewals with Tegus or Sentieo over the years, which is likely why AlphaSense decided to combine them all and delay the inevitable contraction of tooling revenue.

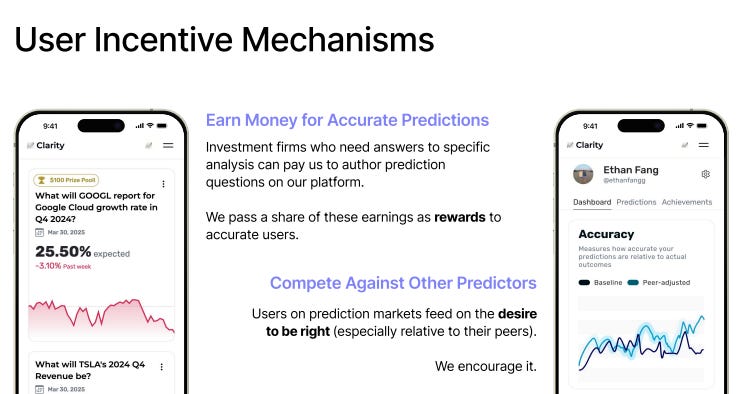

As a result, we’d like to entirely front run this development, and offer a meritocratic distributed research platform. Instead of firms relying on hiring and training analysts, doing expert calls, hiring consultants, etc, just open up our portal and get the collective research of hundreds or thousands of users. This has a plethora of advantages if we are right.

You cannot recreate it internally without spending billions just on headcount

Research and predictions of thousands of users are vastly more liquid than your own internal analysts can ever hope to achieve

Society has proven that markets outperform experts in pretty much every field

Distributed economics make it vastly cheaper than even software tooling, let alone adding headcount

The incentive is simply be right on KPI’s, not get your name in the book.

Any data sources get “arbed”. Why buy Yipit when some analyst will simply report their numbers on our site?

Benchmarking internal analyst accuracy is extremely rare and quite difficult. We can do it quite easily and are incentivized to do so.

PM’s can focus on their strengths and predicting trends/the future, not worrying about the KPI game.

Again, many steps between no product and end state, but that’s the general idea.

Our view is that in a world where we can create a liquid prediction market for financial KPI’s, there isn’t really a reason to have most other tooling.

It also has the benefit of being greatly beneficial to analysts! Our basic model is to share cash payments with analysts based on ranking. Lots of TBD, but it’s pretty neat.

Predicting is entirely self defined. Is it a full time job? Passive income for work you already do?

Purely KPI focused, not “go edit slide 19 for typos” and “what will OpenAI be spending on Azure in 2035”

Objective track record of performance.

You can flex on your friends instead of sitting behind NDA’s

Collaborative research is really fun

Fin:

Hopefully this article is somewhat interesting and/or useful. I always find it helpful to put my thoughts to digital paper.

More updates on Clarity will be coming as we work on finishing our fundraising. We also have had a few Twitter angels which we fully welcome as long as you end up using our product! Always open to feedback and thoughts and truly appreciate the power of the digital community. Hopefully we can give a lot back with Clarity.

Cheers.