$CDLX - The Most Unownable Stock on Wall Street

And why that may be a good thing.

Intro:

I have frequently tweeted about CDLX and have followed the company for a decent while now. I started buying shares earlier this year and my current cost basis sits right around $10. While the current drawdown is certainly unfortunate, I believe it is unwarranted and represents a great opportunity, which is why I doubled my share count at ~$5. I hope to explain my logic below, thanks for reading.

Additionally, if you are interested in CDLX follow Austin Swanson on Twitter, he’s an excellent resource.

What is CDLX?:

As a brief intro, CDLX is a company primarily derives revenue from serving ads within your bank’s app or website. Wells Fargo for example will have an “Offers” section with % cash back at various brands. This is powered by CDLX. What CDLX does analyze your transaction data on that bank account to determine which ads to serve you. Say you frequently shop at SBUX but Dunkin Donuts is having a promo, they might advertise Dunkin Donuts to you via CDLX in an effort to convert you from SBUX. They can then see with certainty if you transact on that advertisement based on analyzing your purchase data.

So what’s the value? For advertisers they can get very explicit targeting with near perfect attribution at pre-determined ROAS. The targeting and attribution sides of advertising have been made more complicated with the likes of AAPL’s ATT changes and play a key part in lowering CAC for businesses. CDLX is able to essentially guarantee a certain CAC/ROAS (Customer Acquisition Cost/Return on Ad Spend) as advertisers pay per transaction on users served an ad. This avoids multi-touch attribution headaches and potential overspending on ads with murky ROI.

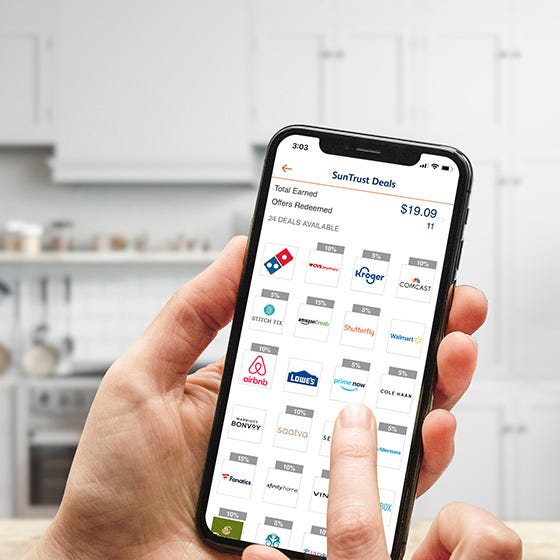

So what’s the downside? The downside for CDLX is that while economics of ads are essentially guaranteed, volume is not. CDLX TTM revenues of ~$306m are below many companies quarterly advertising budgets. Despite MAU’s of >180m, overall platform engagement is quite low as CDLX offers are embedded within bank apps, hardly known for their advertising prowess. Additionally, the UI is frankly ugly as seen below. The channel is just horrible and CDLX has no control over the banks UI decisions.

So what’s the opportunity? Engagement sucks but that also means it has a long runway. Revenue has CAGR’d at about 17% over the past 5 years despite current macro headwinds, minimal product improvements, and the loss of SBUX and ABNB due to factors largely beyond their control. They are currently working on rolling out their “New Ad Server” which is a project 3 years in the making. I’ll skip the long explainer of why I believe this could materially double revenues conservatively and simply show you what it would look like (the app is Dosh, which CDLX acquired and former employees have stated is the template for the new ad server UI)

Clearly, adding better visuals and explainers instead of logos with a cashback number tossed on top is more compelling for customers. That is one main goal of the new ad server. Others include product level offers (instead of brand/store wide) which can unlock CPG budgets, new offer types, in app shopping, etc. Frankly for now the concern on the stock isn’t the long tail so I’ll avoid spending too much time. Simply put, I believe the new ad server can unlock excessive value over time and allow them to compound at at least 17% going forward.

What’s Gone Wrong:

While the new ad server is a significant opportunity, it has taken forever to roll out. Previous management indicated it would release on JPM Chase’s platform in late 2021. It actually did not launch until Q3 of this year, and the new UI experience won’t launch until Q1 of 2023. I’ll skip the in depth explanation, but basically CDLX was a company founded by bankers that sort of stumbled into some great data (bank transaction data). It was not at all a technical organization, and the tech stack was dysfunctional. Former CEO Lynne Laube did a great job building relationships with banks and growing MAU’s, but when growth had to come from tech execution, the company stalled.

In early/mid 2021 they realized the tech stack was shit and hired new CTO Peter Chan. In August 2021, Peter fired almost the entire data department and had to quickly revamp the tech stack to suit future ambitions, pushing back product rollouts that were promised by tech ignorant management. Since then, Lynne has stepped down as CEO and been replaced by Karim Temsamani who worked in payment/ad related roles at Stripe and Google and is by all accounts much more capable on that front. The old CPO Michael Akkerman was replaced with Jose Singer, one of Chan’s former Yahoo colleagues. Basically, management had no idea what they were promising was functionally impossible, which led to significant product delays, degraded relationships, and investors feeling bewildered by a seemingly unexplainable lack of execution.

Since then, the underlying tech stack has been drastically improved by all accounts, engineering talent has continued to flow into the company, and they have moved to cloud development processes instead of dozens of custom on-prem solutions which should increase development cadence. On the results front, within the first quarter of Karim being the CEO they rolled out the new ad server for JPM Chase, their largest customer, as well as other previously unannounced banks. Karim in short seems like an excellent pickup that has been working on payments advertising for over a decade.

Despite these challenges, revenue has continued to CAGR comfortably in the high teens since 2017, so imagine if the company can actually execute!

Current Additional Headwinds:

All of the above is nice, but not super relevant to the current stock price. I outline it simply to get a base understanding of why I believe the company can compound once past it’s current troubles. So what are the current issues?

Macro headwinds and weak YoY revenue growth guide for 4Q22

Bridg Earnout Payments and Disputes

Liquidity

Let’s take these in parts shall we?

Macro and Growth:

CDLX recently guided to $80-$90m of revenue in Q4. Expectations going into 2022 were ~$100m and expectations in August were also about $100m. Consensus was dropped to $93m immediately prior to earnings, but regardless a midpoint of $85m is far below what many were expecting and signals -6% YoY growth at the midpoint, hardly what you want for a FCF negative ad company with liquidity limits heading into poor macro.

I personally couldn’t care less about the Q4 guide for a couple of reasons. First off, CDLX lost SBUX which made up 10-20% of their revenues historically. This was due in large part to the CEO shift at SBUX. It is arguable of course that if CDLX performed better SBUX would keep them on, but regardless overall revenue concentration has declined meaningfully and growth ex-SBUX was actually ~30% YoY in Q3 and likely ~15% YoY for the 4Q guide despite significant macro headwinds. Once these comps are lapped the revenue growth number will look much cleaner.

Additionally, 4Q is prior to the new ad server experience rollout. Given that I believe the new experience can at least double revenues, I’m not too concerned about near term growth rates. As long as CDLX isn’t churning off every large account in Q4 they should be fine going into 2023.

Lastly, CDLX operates in a niche that is intuitively recession resistant vs advertising peers. They will suffer from a lack of customer conversion reducing the ability to move budgets through the platform, but explicit ROAS is highly valuable in uncertain budgetary environments. We are no longer in a land of “I literally can’t spend my ad budget let me just dump it into GOOGL/META” and bottom line is starting to matter. SNAP called out weakness in brand advertising on their Q3 call for example, while AMZN ads performed the best out of FAAMG, likely due to their directly attributable nature. While CDLX does have niche risk as clearly demonstrated with SBUX, I believe it unlikely their offering unwinds dramatically in such an environment. I find comfort in this belief with their ~30% growth in Q3 ex-SBUX and record ad counts despite how horrible the platform is.

Bridg Earnout’s and Disputes:

CDLX noted in their Q3 report that Bridg is disputing the first earnout payment. Since I doubt many of you have read the merger agreement, let me give you a brief rundown of how this works.

Essentially there are two payments, one in 2022 and one in 2023. The first payment is calculated as 20*(April 2022 Bridg ARR-April 2021 Bridg ARR). This payment amount according to CDLX is ~$126m. Of this $126m, CDLX must pay at least 30% in cash, so $37.8m. The remainder of the 70% can be paid in stock. One misconception I have seen is that this stock would be valued at current prices, implying a near double of the share count. The share price to determine how many shares must be distributed is actually based upon the Volume Weighted Average Price for the 20 trading days prior to May 5th 2022, which was ~$40 per share. Thus CDLX must pay ~2.2m shares, or 6.5% dilution, hardly a doubling of share count. The dispute according to CDLX IRR is surrounding the ARR calculations made to determine the payment amount, not the share price of the distributed shares. CDLX certainly should have disclosed this as many investors probably didn’t read the merger agreement, but such is life.

In terms of the dispute, I’m not exceptionally worried. While it is quite sensitive to any changes, I’d imagine they didn’t fuck it up too hard, if at all. Contractually the dispute should have resolved by October, so I believe it is in actuality more of Bridg getting ahead of the 2nd payment which might be a touch iffy.

You see, the 2nd payment is calculated as 15*(April 2023 Bridg ARR-April 2022 Bridg ARR). Now I don’t think you need a PhD in Game Theory to realize that paying 15x ARR for any incremental revenue is fucking moronic. If CDLX grew Bridg ARR by 10m (~45%) they’d have to pay $150m, more than the current market cap. The merger agreement dictates that CDLX cannot explicitly tank Bridg operations, but extenuating macro and an environment where your stock you’d use to pay for the transaction is down >90%, you get some weird incentives. CDLX is guiding towards a payment of ~$69m, implying a mere $4.6m increase in ARR YoY vs 2021’s $6.3m increase when the company didn’t even have a way to utilize the data (CDLX only began running limited Bridg data offers in Q4 of 2021). If we assume $69m is the payment and current stock prices are used, we run into a slight wrinkle with the merger agreement that stipulates CDLX cannot dilute itself by more than 20% per payment. CDLX would be forced to pay $42m of that $69m in cash, which would bring total earnout payments to $80m vs a current cash balance of $140m+$60m of revolver. Not the cleanest place to be balance sheet wise, and you’re getting hit with nearly 30% dilution as a shareholder. For these reasons, I suspect CDLX and Bridg are in a dispute due to a want to settle. CDLX is financially incentivized to tank Bridg ARR as hard as possible YoY, so reap what you sow with shitty merger agreement terms when things go south. That being said, I doubt Bridg wants to bankrupt CDLX over this. $80m in cash is hardly anything compared to the initial payout of $350m and a 20-30% ownership stake in CDLX. $0ing CDLX for that money would be only marginally cash positive for Bridg shareholders, many of which are also current CDLX employees.

All in all, I’m doing a lot of speculation here, but the clear path to me seems like a settlement between CDLX and Bridg to ensure stable liquidity on their path to being FCF positive. Amit Jain the Bridg founder is still with CDLX and a former Googler like Karim, so I’d imagine relations haven’t soured too hard and he is clearly incentivized to work this out. Sure things could break and maybe I’m totally wrong, but it seems unlikely.

Liquidity:

I’ve tossed around a couple numbers above, but let’s get the facts straight. CDLX has $138m of cash and $60m of revolver (subject to Accounts Receivable-$15m as the cap). At worst I’d guess this goes to $40-50m of capacity. Let’s less $80m for Bridg earnouts assuming no improvement in share price or settlement, and an accurate guide to get to $118m of liquidity.

CDLX Q3 expenses looked something like this:

50% of revenues in partner fees

$48m of OpEx+Delivery Fees

$3.3m of CapEx

$575k of Interest Expense

$5.2m of RIF related expense anticipated in Q4

OpEx and such was down sequentially from Q2 due to RIF and the fact serving cloud based ads is essentially 0 marginal cost. Management has committed to future cost reductions of at least ~$20m annually, so I’m rather confident that growth can be done while dropping OpEx a touch. Headcount was brought down sequentially from 710 to 641 in Q3 and Karim has expressed the balance sheet is his #1 priority. So all in all, I’m confident run-rating $50m or less of expense per quarter.

So what does this mean? Let’s assume Q4 comes in at $86m, CDLX would burn $14m of cash vs liquidity of $118m ex-Bridg. We then enter 2023 with $104m of liquidity. If in 2023 we saw -12% in Q1 (~5% growth ex-SBUX from 30% in Q3), -7% in Q2 (~10% growth ex-SBUX from 30% in Q3), then began benefitting from the new ad server and closed out the year at +9% in Q3 (~15% growth ex-SBUX from 30% in Q3) and +21% in Q4. In such a scenario, CDLX would burn $30m of cash vs $118m of available liquidity and be roughly FCF-CapEx breakeven in Q4 of 2023. If growth were to normalize to high 20’s YoY in 2024 as the new ad server is further rolled out and easy comps are realized, you can get to a scenario where CDLX is trading at less than 10x 2024 FCF, and a LSD multiple on 2025 FCF with plenty of runway (extrapolate this out and you get a rather obscene IRR near the triple digits)

For liquidity to break we would need revenues to decline 30% or more in 2023 despite easier comps AND a new UI with their largest bank partner as well as no Bridg settlement and a heavily deflated stock price. Even in such a scenario, it’s pretty close and getting some kind of Bridge financing (ha!) is likely doable if the fundamentals inflect as expected from the new ad server.

Overall:

I believe CDLX has a clear compounding future path to significant FCF as their underlying business inflects. I do acknowledge previous iterations of the company have been less than stellar and the current channel is certainly lacking. The fact CDLX has grown despite these factors is indicative to me of the underlying value proposition. As these headwinds begin to become tailwinds in 2023 I expect great things from the company and have been encouraged by execution of new management thus far.

Liquidity and macro concerns seem dramatically overstated given the potential upside here. The stock is priced like its either ex-growth or about to go bankrupt, neither of which seem true. This is likely not helped by heavy shorting in anything tangential to Clifford Sosin and related funds. While CDLX may have a rough Q4 ahead, I plan to continue to add shares and believe I am being more than compensated for any execution, macro, or earnout risk. Hedge funds are likely heavily wary of the name given the new microcap status, CAS risk, uncertain Bridg risk, and other nonsense risk like JPM exit risk (why would you exit a platform you just spent time and money investing in?). In aggregate, I believe many of these concerns simply are irrelevant or of minimal importance, but provide a great opportunity for nimble smaller shareholders.

Thanks for reading and I hope this was helpful. As always, DYOR, I’m not a messiah and if you follow my investments blindly and lose money I won’t feel bad, but you will. If you’d like to chat about CDLX feel free to toss me a DM any time. If you’d like to subscribe you can do so below. Until next time (probably about CVNA)

As a former CDLX engineer, let me tell you - the tech stack is still absolutely terrible. Part of that is driven by banks' pre-historic banking infrastructure, but most of it is because CDLX cannot for the life of them figure out how to do "product-led engineering." The company still basically doesn't have a product team, and I don't see that changing anytime soon.

Great write up though. Most of this is spot-on.