CDLX Intro:

I have written an ample amount about CDLX, but I intend this to be a bottom’s up thesis, so I’ll give a brief intro of what CDLX does and cover all of my thoughts about the business below.

The short form thesis is essentially that CDLX has ~40% incremental EBT margins, trades at 0.3x revenue, and can CAGR revenue at ~20-30% going forward, reaching FCF neutral in 3Q and trade at a low single digit multiple of 2025 earnings. It appears optically low quality and negative growth due to their largest customer SBUX churning when Schultz came back in and cleaned house. SBUX was ~20% of revenue and churned in 3Q. The stock has sold off heavily along with regional banks which pose essentially 0 risk to CDLX. Once the earnout issues are resolved and the new prodoct proven with uplift, shares will rapidly re-rate.

In theory.

Justification for said theory below.

Liquidity model here and valuation idea here if you’d like to skip the fanfare.

What Does CDLX Do?

Cardlytics is a marketing and analytics platform that partners with banks and other financial institutions to analyze consumer spending data and offer targeted advertising to their customers. Essentially, Cardlytics helps brands reach consumers who are most likely to be interested in their products or services, based on their spending habits. They do this by analyzing transaction data from millions of bank customers, amounting to >50% of annual US card swipes across 186 million users.

The advertisements function as activatable cash back buttons within partnered bank apps and look something like this.

As an example: Domino’s can partner with Cardlytics and ask Cardlytics to send a 10% cash back offer to customers that normally shop at Papa John’s. It can also be less direct and along the lines of “Domino’s customers also buy Pepsi, video games, and shop at Kohl’s” and Cardlytics can then create a profile and serve ads, similar to other interest based ad platforms.

Why Is It Valuable?

Cardlytics operates within a 4 pronged value system.

Banks

Advertisers

Bank customers

Cardlytics

Banks:

For banks, the value proposition of Cardlytics is rather simple, free customer retention. Almost any card you can get in the US will offer some kind of cash back bonus in an effort to attract customers. Cardlytics offers something along similar lines. Basically as a bank, in exchange for a small amount of additional tech cost you can offer your customers “free” cashback, with the goal of making them spend more on your card and spend more time on your website/app, opening up more cross-sell opportunities for loans and other products, and encouraging customer loyalty. AmEx has made an entire business out of this model that consumers will actually explicitly pay for! I would also add that banks get paid ~50% of Cardlytics revenues, making Cardlytics beneficial to the bottom line both explicitly and implicitly.

Beyond my own words, simply look at the actions of banks. Cardlytics top customers include:

JPM Chase - Launched 2018

Bank of America - Launched 2012

Wells Fargo - Launched 2020

US Bank - Launched 2020

PNC - Launched 2011

Truist - Launched 2017

Lloyd’s (UK) - Launched 2013

Santander (UK) - Launched 2014

Currently my estimate of MAU concentration is something like the follow:

JPM: 45% of MAU’s

BofA: 30% of MAU’s

WFC: 10% of MAU’s

USB: <5% of MAU’s

PNC/Truist: <5% of MAU’s

Lloyd’s/Santander: <5% of MAU’s

Other: <5% of MAU’s

Cardlytic’s MAU’s provide a good visual of the continuous growth of the platform

Cardlytic’s has also never churned a bank customer, so fair to say banks find it positive.

The offering simply makes intuitive sense for banks. You are sitting on a treasure trove of data that can be value add to advertisers, but don’t want to source offers yourself and build/maintain tech, so just hire someone else out to do it, and get paid for it!

The downside of course is that when you have all of the largest consumer banks it naturally becomes harder to grow your user base at similar rates and you instead have to focus on increasing engagement. This has been a bit of a tumultuous journey for Cardlytics that we will explore in depth below.

Advertisers:

Cardlytics is useful for advertisers for several reasons:

Targeted Advertising: Cardlytics allows advertisers to target their ads to specific audiences based on their actual purchase behavior. This targeting is more accurate than other methods, such as demographic targeting or interest-based targeting, because it is based on real purchase data.

High-Quality Data Analytics: Cardlytics provides advertisers with high-quality, first-party purchase data from millions of bank customers. This data is more accurate and reliable than other types of data, such as surveys or website tracking data. You didn’t know your customers shopped at companies XYZ? Now you do!

Cost-Effective and high ROI: Cardlytics offers cost-effective advertising options for advertisers, allowing them to reach a highly targeted audience with relevant offers. This cost-effectiveness is due to the accuracy of the targeting, which reduces wasted advertising spend. Cardlytics can be tuned to exact Return on Ad Spend values due to the nature of the “cash back” platform, allowing it to always have guaranteed high economics.

Measurable Results: Cardlytics provides advertisers with detailed reporting and analytics on the performance of their campaigns. This allows advertisers to measure the ROI of their campaigns and make data-driven decisions to improve future campaigns. There is no need for complicated attribution analysis, Cardlytics can determine sell through perfectly with attribution data.

Large Reach: Cardlytics has partnerships with many of the world's largest banks and financial institutions, giving advertisers access to a large network of potential customers. This broad reach allows advertisers to reach a wide audience with their campaigns.

In short, Cardlytics can provide guaranteed economics on ads to a wide range of potential consumers and even show data analytics insights advertisers may not have previously been privy too.

The downside here is that Cardlytics is heavily scale dependent. Cardlytics basically operates as a money printer, advertisers set parameters like “I want $5 for every $1 spent”, but doing so is not worthwhile if you’re only getting back $5 and not $5m dollars. It’s like if you could double your money but it takes 30 minutes. With $1 that’s a waste of time. With $1m you do that all day.

Churn on the advertiser side is more of an issue. There’s no exact numbers but it’s maybe 80-85% retention and they have lost their largest customers ABNB and SBUX previously. With both there were extenuating circumstances related to overall advertising budget changes, but even with budget shifts you don’t turn off a money printer if it’s giving you enough money.

A key point of the thesis is that Cardlytics has an opportunity to drastically improve user engagement and breadth of platform in the future with their new product, which I’ll touch on more below. Other than this volume hiccup, Cardlytics represents exactly what advertisers want in perfect attribution guaranteed economics advertising, especially for actual brick and mortar businesses that have a harder time with digital ad attribution. Cardlytics’ largest customers by sector are Travel & Entertainment, QSR’s, Grocery and Gas, etc.

No fancy graphs or anything, but I’ll go out on a limb and say that digital advertising and attribution are secular trends that are going:

Bank Customers:

For bank customers it’s pretty simple, Cardlytics is free money. I’ve bought a META headset and gotten 5% back. I’ve bought Adidas clothes and gotten 10% back. I’ve bought a Costco membership and gotten $20 back. For a few minutes of my time I’ve gotten a bunch of free money.

There are a few common concerns here (because free money is surely too good to be true) so let’s explore.

First is the concern that consumers will simply use Cardlytics offers to buy things they would already buy and get a discount. This is controlled by the fact Cardlytics can prove incremental spend due to the wide swathe of purchase data they have. Cardlytics can easy see and show that consumers who saw and interacted with the ad spent more than those who did not see and interact with the ad. Example: You show the ad to 100 consumers and don’t show it to another 100 (whom you can profile nearly perfectly). The consumers who get the ad buy 20% more, indicating incremental uplift. There is some work in getting advertisers to go along with this as it’s not how any other platform works, but generally will move in the direction of acceptance.

Second is the concern of “who gives a shit about 5% off at Starbucks”. This is admittedly fair, but on the other hand who gives a shit about a non-cashback advertisement? The main thing is simply putting an ad in front of someone and priming them to make a purchase. What matters more here is a consumers interest in interacting with the platform and being served good ads. 5% back at SBUX may not be meaningful, but $20 back for a Costco membership or $100+ back for a hotel can add up quickly can you might as well grab SBUX while there.

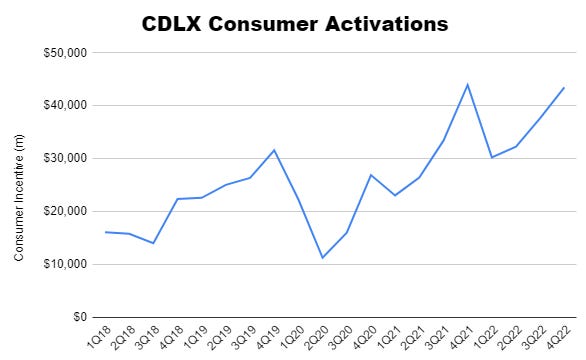

The third concern which is the most valid is “who shops in a bank app?” This is admittedly an emerging consumer preference, but to some extent the numbers speak for themselves. Cardlytic’s consumers redeemed ~double the offers in 2022 as they did in 2018, a 19% growth rate. The majority of this is likely due to user growth, with MAU ~tripling over the same time frame. Unfortunately MAU’s is not a clean indicator of actual user counts and underlying engagement trends, so we are flying a bit blind here, but the general consistent trend has been upwards and channel checks at bank branches indicate consumer awareness generally increases and is sticky over time. Economic uncertainty also obfuscates underlying engagement as if advertisers aren’t spending due to Covid or recession fears, there are less offers to drive engagement.

With user engagement we are again banking slightly on Cardlytics’ new ad product to drive upwards trends in engagement. I’ll touch more on the technical aspects of this new ad product later, but compare the example below to the UI presented above to get an idea of how this could drive further user engagement. The new ad product includes images in offers to drive a more compelling user experience, similar to any advertising platform.

The numbers also speak for themselves: “In 2022, our data showed customers engaging with our program spent 1.2x more on their card and made 1.3x more shopping trips than unengaged customers. And clearly, it works well for advertisers. We increased the total number of advertisers in the channel by 8% in 2022. Not only that, but we also increased the number of advertisers with billings between $500,000 million and $5 million by 17%, and we increased the number with billings greater than $5 million by 44%” - 4Q22 Call

Cardlytics:

Generally when giving free money someone is the patsy, and it usually is the shitty SaaS overlay trying to skim value. In this case, Cardlytics makes ~33% of total advertiser billings as revenue (with 33% going to banks and 33% going to customers), so the margins are rather equitable, with the banks and consumers effectively getting free money. Advertisers get guaranteed terms and pay based on realized sales, so no losing there. Due to the near 0 incremental cost of serving an ad Cardlytics keeps around 25% of billings as gross profit. Thus we have an interesting case where every single party explicitly gains value from every transaction. There’s no “sure one party loses money, but it’s a loss leader” type of adjustment happening here as is usually common, just pure value add.

In terms of durability, despite the appearances Cardlytics is actually a rather sophisticated data analytics company. Parsing billions of transactions each year and formatting them into workable data requires an immense amount of knowledge and expertise that is basically unmatched. Banks are very stingy with data sharing (rightfully so) and Cardlytics is the ONLY company with access to the data they have.

Additionally, due to being a neutral third party, Cardlytics is able to provide scale that singular banks cannot. If Wells Fargo tried to launch a Cardlytics equivalent on their own, they would have 1/10th the scale to sell to advertisers for a product that is largely scale constrained, making Cardlytics worth more than the sum of its parts when it comes to getting ad deals done.

Given no financial institution has ever churned or provided data to another provider, I find it rather safe to say Cardlytic’s effectively has a monopoly on the advertising within bank platforms. As long as banks maintain them and the value prop is clear for advertisers and consumers, they will get used. Thus I don’t see any disintermediation/platform risk or economics degradation risk as is common in these types of companies (see GDRX and Kroger). The main question is simply if Cardlytics can grow at a sufficient pace to justify investment.

The Mechanics:

At this point I hope it’s clear that while Cardlytics is not perfect, there is clear demonstrable value in the platform existing for all parties. Before moving on I wanted to touch a bit on the mechanics of how Cardlytics works at a technical level as it’s quite relevant here.

While Cardlytics is a technology focused marketing company, those are not it’s roots. The two co-founders Scott Grimes and Lynne Laube were not at all marketing or technology inclined individuals. They came from Capital One’s payments division with a great idea (using data for marketing), an understanding of banks, and not much else.

The pipes of Cardlytics are complicated technologically but rather simple to understand at a basic level. Essentially it operates in steps.

Cardlytics analyzes a banks anonymized customer transaction data, decoding data and attaching it to customer profiles to use for targeting.

An advertiser places an advertisement with Cardlytics, outlining a set of targeting parameters which Cardlytics fine tunes and uploads on their backend.

Whenever a bank customer opens their Cardlytics offers, the bank app sends Cardlytics the customer’s ID and Cardlytics sends back a list of offers.

The offers are presented to the customer, who activates them as they wish.

Cardlytics see’s a transaction related to an offer in their data, and issues cash to the customer.

Unfortunately the devil is in the details with Cardlytics.

Tech debt is always a problem to consider and it becomes extra problematic when working with banks. On the backend side Cardlytics basically had a ship held together with duck tape that was spun up as needed and without sufficient technical direction. Individual data scientists were writing custom targeting scripts for each campaign, there was essentially no automation. This is extremely atypical in the ad industry where your time to market with a Google or Meta is measured in minutes or hours, while at Cardlytics it would frequently be measured in weeks. Once campaigns were put up, they could not be edited without being taken down and re-placed, all white glove and not self service. If a campaign didn’t perform as expected you wouldn’t know for weeks as an advertiser, whereas Google and Meta have real time analytics within hours. Basically it was a shitshow due to a combo of a lack of foresight, lack of expertise, and classic start-up “it doesn’t matter right now”.

And that’s just the backend.

On the front end side Cardlytics was running custom code placed within each banks own data center. Want to change the pixel alignment? That will be a 2 month bank review and lengthy security audit process. Also you might just get declined arbitrarily! It’s hard to fault Cardlytics too much here as banks simply are a pain to work with on the technology side, but it’s fair to say they weren’t working with an A+ team and likely could have done better here.

Funnily enough these issues were probably at their peak in 2021, similar to when the stock price peaked. Lynne was promising self serve, a quick roll out of the new ad server, and rapid revenue acceleration. Fast forward 2 years and self-serve is cancelled and the new ad server and UI is only partially rolled out at JPM to F&F! Management simply had no clue where they were at on the technology side and were promising things they couldn’t deliver. The stock simply shouldn’t have been at $140.

Don’t just take my word for it, from my previous substack:

Thankfully for myself and you, Cardlytics began making significant upgrades to the technology in late 2021. They hired CTO Peter Chan from Amazon/Yahoo who promptly dissolved the majority of the bespoke data science team and put Cardlytics on a path towards higher automation and efficiency. Since then the majority of banks have shifted to an AWS based API instead of in-house partitions, drastically improving product iteration speed and reducing workflow complexity by consolidating versions. The Cardlytics backend has been increasingly automated and improved with metrics planned to be shared later this year. The new CEO Karim Temsamani, formerly of Google, believes that Peter’s work has been invaluable in transforming the technology of Cardlytics.

The culmination of these efforts is the launch of the new ad server on JPM Chase in Q4 of 2022. That new ad server also powers the new UI in the gif above as well as a number of other speculative but planned offerings, such as ordering (yes, ads were presented to customers in a random order. Imagine Google keywords being random…), video ads, in app shopping, and a multitude of more technical things I won’t get too into. Basically it’s a lot better and Peter Chan and his team are directly responsible for a good chunk of that improvement.

Why Is the Stock Shit?

It’d be a bit silly to pitch a stock down 98% from highs without touching on the why. Now that we are familiar with the mechanics, we can do this in a rough timeline format.

Cardlytics stock was a total darling until around the Q2 2021 earnings report, which missed topline revenue growth estimates by 6%. Frankly I believe management lost the plot leading up to this quarter. They went on an acquisitive spree, buying Dosh for $275m in an acquihire that cost 4x the current market cap. They bought Bridg which will likely cost them >$500m, 6x the current market cap. They were also focused on launching support for a bunch of fintechs and neobanks which as far as I am aware generate a LSD % of revenue in aggregate. Q2 was the first quarter of MAU growth starting to level out to single digits and I think management just wasn’t prepared for shifting to a product lead strategy. The stock sold off from ~$130 to $80 following the report while management blamed transitory issues and looked forward to self-serve revamping growth

Q3 of 2021 was more of the same. This time a top line beat and no drastic sell off, but again saying “new ad server and self-serve are coming” as channel checks started to degrade. Agencies were saying self-serve was basically non-functional and still required white glove assistance, essentially just acting as a pre-fill form instead of a phone call. The stock went from $80 to $60 as macro concerns started to heat up in early 2022. To be clear, nothing drastically bad was happening, simply a lack of releases and marginal disappointments. The expectations were still high, but slightly delayed.

Q4 of 2021 was a drastic beat on the topline, but macro concerns surrounding spiking inflation and Russian invasion dragged on the stock price. Despite popping 14% on the report CDLX ending up declining 3% the week following. The report however once again included empty promises about self-serve and the new ad server. Banks move slow, but doubts were beginning to arise and channel checks indicate little to no progress was being made on the tech side. Headcount had also ballooned in 2021. After starting the year at 471, they ended it at 591 and basically doubled OpEx. OpEx had previously CAGR’d at 10-15% historically (because there is 0 incremental cost to serving ads to more people) so spending was a bit out of line if future growth didn’t mature as expected.

Q1 of 2022 is when the optics started to unwind. Revenue was a slight beat, however they brought in a new CPO with still nothing to show for nearly a year and a half of talk on the new ad server and self serve. Management had also told investors there would be more engagement metrics shared in 2022, which inexplicably failed to materialize. Additionally there were some delays with the re-signing of Bank of America which caused investor concern as it was supposed to happen at the end of 2021. Questions were mounting and answers weren’t happening. The stock was now $30 or so, with deteriorating macro and no near term profitability overweighing empty promises.

Q2 of 2022 is when things fell apart. Topline missed slightly. Their largest bank client JPM Chase acquired basically their only competitor (bad optics, but the competitor sucked and has been used for other things). There was still 0 line of sight on a new ad server rollout, self serve was being rumored as cancelled after 1.5 years of work, none of the neobank/fintech investments had gone anywhere, and the CEO was stepping down (that last one was a good thing.). Cardlytics also happened to lose Starbucks, which made up 20% of revenues after the CEO change in mid 2022. A confluence of bad news at a bad time.

Following the Q2 report, the stock was trading at around $15, down nearly 90% YoY.

Since then the biggest issue has been macro and an “earnout” related to one of their 2021 acquisitions. Essentially they agreed to pay 20x the ARR difference from when they purchased a company called Bridg to the anniversary date of said purchase. They also agreed to pay 15x the ARR difference from the first anniversary date to the second anniversary date.

So what happens when you have to pay silly amounts of money for something not nearly worth that much anymore when your stock is down 90% due to drastic multiple re-rating and you are cash strapped and unprofitable? Generally dilution or solvency issues, which happen to be bad for equity investors.

Liquidity

This is a bit too complicated to write out, so I made a liquidity model here to follow along. Here’s my previous post on this as well.

General gist of it, Cardlytics is under most circumstances totally fine but could face a legitimate liquidity crisis in late 2023 under specific circumstances because the CFO was a silly goose and planned to pay for everything in stock with a stock that’s down 98%. They even did a buyback to offset dilution in 2022 despite no line of sight to profitability! (Thus when the CEO “resigned” a few days ago, it was hardly surprising)

The important variables for liquidity are as follows:

Earnout 1 dispute resolution.

Earnout 2 amount

Ad macro environment

Cardlytics rolling out the new ad server

On variable 1, I am inclined to believe Cardlytics will be favored in the earnout. The earnout agreement writes in plain English the terms of ARR calculations which are being disputed. Mechanically the way this earnout works is that Cardlytics pays 70% stock 30% cash. The price of shares used for payment is based upon the VWAP in April of 2022, which was about $40. A common misconception is that the earnout dispute could reprice these shares. That is not the case. So even if this amount was $10m higher as an example, Cardlytics would only lose $3m cash and pay the rest with $7m/$40=175k shares, worth about $500k at current prices. Quite the bargain. Thus unless the 1st earnout accounting was drastically mishandled I doubt this is significant news. We expect an earnout sometime in April at the moment, with management repeatedly saying they are confident in their position.

Variable 2 is a bit trickier. Instead of being based on the VWAP in April of 2022, this one will be based on the VWAP of April 2023, which currently sees the stock at less than $3, not $40. The current projected amount for this earnout is ~$68m. To pay 70% in stock would require $47m in stock, or 52% of the current market cap. Thankfully for us equity holders, the max Cardlytics can dilute us is ~20%, implying an issuance cap of ~4.4m shares. Unfortunately for us equity holders, this leaves a minimum ~$57m of earnout payment due in cash versus a cash balance of $122m and revolver availability of ~$50m. Cardlytics will additionally owe ~$38m in cash for the first earnout, leading to a total cash reduction of ~$95m, meaning a remaining cash balance of $27m. Meanwhile Cardlytics will burn ~$15m in Q1, leaving cash at $12m. They will likely burn another ~$10m in Q2, leaving available cash at $2m. Which brings us to variable 3.

Variable 3 is a big question mark. The ad market has sucked over last few months, with Cardlytics revenue down 8% YoY in 4Q22 and projected to be down 15% YoY in 1Q23. Given Cardlytics would have ~$2m of cash after Q2 and guided to FCF neutral in Q3, many are skeptical of their ability to grow in a poor ad market. I believe this is optically misleading as a large reason for Cardlytics’ poor growth is lapping a period where they used to have Starbucks making up 20% of revenues. Ex-SBUX growth in 4Q22 was ~10% and 1Q23 ex-SBUX would be ~MSD % growth despite atrocious macro. The nature of Cardlytics’ perfect attribution platform is more attractive in times of stress, which is evidently shown in their embedded growth rate outperformance versus other ad tech competitors.

Variable 4 is a bit iffy as well. The new ad server is core to managements guidance of cash flow neutral in 3Q23. They expect ~20-25% implied YoY growth which is largely driven by the new ad server. Historically management was entirely untrustworthy regarding product timelines, so trust is rather low.

That said, even if the new ad server doesn’t roll out on time and revenue is simply flat YoY in Q3, liquidity is still more than fine in the near term assuming the revolver is stable, which I see no reason why it wouldn’t be given it’s secured by $120m in accounts payable.

Liquidity flexibility also tends to be higher than expected in my experience. Companies that are total pieces of shit get funding for far longer than they should. Cardlytics provides legitimate value to a multitude of players which awards it with some flexibility that isn’t necessarily baked in. Equity raises can also be in the picture despite dilution. Equity raises can also interestingly be significantly reflexive, as the higher the equity, the lower the bankruptcy odds, so the higher the equity. The reverse is also true which has likely contributed to the current sell off below $3. But if one believes near term liquidity is workable, the key question becomes execution.

Karim:

A key piece in the Cardlytics puzzle is Karim Temsamani. Karim is a former Google and Stripe exec who Lynne chose as her replacement in August of 2021. Karim comes with a special background of tech/banking/advertising that is highly relevant to Cardlytics. Some examples perhaps:

“Karim Temsamani joined Stripe in April 2019 to lead strategic vision and execution across product and engineering for Financial Products (Stripe Capital, Stripe Treasury and Stripe Issuing). In November 2021, Karim transitioned to running Global Partnerships for Stripe across banks, networks, and technology companies.”

So a combination of product/engineering leadership as well as partnerships and sales

Stripe Issuing/Treasury are bank products using AWS and API integrations - sound familiar?

His partnership role was also heavily involved in payments and data

He was a direct report to the CPO at Stripe, and came into Cardlytics which was a company that drastically needed product led management, which he has repeatedly hammered in on earnings calls as his focus.

Prior to Stripe, he spent 12 years at Google where he oversaw, for the last 6 years, all of Google’s sales and operations across the AsiaPacific region, determining the strategy for 16 offices and the regional business strategy for Google products including AdWords, AdMob, Google Maps, Google Apps for Business, DoubleClick Ad Exchange, YouTube and AdSense.

Prior to this, he established Google’s mobile advertising business as its Global Head of Mobile. He oversaw the growth of Google’s mobile advertising business worldwide, leading the teams charged with providing advertising services and solutions to thousands of advertisers, developers, and publishers.

This video is interesting - here he discusses Google mobile ad strategy which is strikingly similar to CDLX, including hyper local offers, customizable offers, timed offers, etc. “We need to make the back end simple so advertisers can really use the complexity to their benefit”

Overall it’s pretty clear Karim is a unique mix of product/sales/banking that is a breath of life into Cardlytics. All CEO jobs are also sales jobs by and large, and I won’t elaborate too much but Karim is rather well connected in this sense and believes he can level up Cardlytics’ bank and advertiser relationships.

It’s hard to judge credibility thus far, but Karim’s limited time has been positive. His drastic OpEx expenses saw headcount cut ~30% in 2 quarters and run rate expenses significantly reduced as guided. The new Chase UI also launched this month as guided, however it is not yet in general availability which is a slight hiccup.

The main selling point of Karim I believe is that his focus is on leading Cardlytics growth via the product and bank relationships whereas Lynne wanted to do it via advertisers and fintechs/neobanks. Channel checks prior to Karim indicated that Cardlytics’ bank relationships were quite stale and had some friction due to slow product iteration. The incremental release of the JPM UI is a positive step and Karim has called out making banks happy as his #1 priority. This clearly makes sense as banks fully control the platform and can lean into promotion to users.

The Cardlytics platform is a flywheel effect where engagement begets engagement and the biggest factor of user engagement is actually the bank itself. See this snippet from Tegus.

A bank with a flip of the switch doubled usage - focusing on keeping those guys happy seems like a much better strategy than blowing up headcount to sign irrelevant neobanks!

Valuation and Drivers:

My general model for Cardlytics can be found here.

The key drivers of said model are

Uplift from the new ad server

Bridg growth

OpEx growth

Explanation for all of these are contained within the model. The point that is most up in the air is uplift from the new ad server, so I will outline my confidence.

Intuitively images and additional product improvements can product vast uplift. Channel checks indicate advertisers are quite excited about image offers, SMB’s especially given lower logo recognition. On other platforms image enabled ads tend to have drastically higher engagement - multiples higher in fact. Exact numbers are impossible to pin down, but I assume 1.8x in 3 years, in line with Cardlytics’ historical growth rate.

Once also has to think about these new offerings from the bank perspective. JPM just spent months and millions of dollars implementing this new offering and testing it. They also get a much more visually pleasing offering with more relevant offers and individual targeting. If UK banks saw 100% uplift from push notifications, what happens if JPM promotes Cardlytics offers in the US? Revenue could see extremely rapid upticks at minimal incremental costs. Getting IRR’s >100% is not particularly difficult to imagine.

Additionally, I am assigning 0 optionality value to a company that has a CEO specifically calling out potential optionality and working with proprietary extremely valuable data. I’m sure Cardlytics can continue to creatively monetize the data they have access to as Karim has planned. More product details should come out sometime in May following Q1 earnings.

One thing I cannot hammer home enough is the amazing unit economics here. OpEx has declined QoQ for the last 3 quarters despite sequential revenue improvements. There is legitimately next to $0 of cost for incremental ad serves and this is a business that MUST make do without free money. If they get through this the potential earnings yield is tremendous, with the stock potentially trading at 2-4x 2025 earnings.

Risks:

Generally a 100% IRR doesn’t come without risks, and that is true here.

As outlined in the liquidity model if a mix of bad macro/bad earnout resolution were to occur, Cardlytics could be immediately insolvent. This is risk #1 and a significant overhang on the stock until the 1st earnout is resolved in April. Given the share price and proposed returns, waiting for a resolution before buying in is prudent and something many are doing. This is precisely why I bought in earlier as prudence generally over-estimates forward negative volatility. So far this has worked out poorly, so perhaps I’m an idiot.

Another risk is that the stock is heavily reflexive and people are silly. Misunderstandings of earnout terms around dilution and the VWAP are quite common, with some believing Cardlytics is imminently bankrupt. This is clearly not true if the merger agreement is read, but most people don’t read. This creates negative reflexivity in the stock price, as the lower it goes, the more cash outlay.

Cardlytics currently banks with PACW. I have written about PACW and why I think they are fine here. Cardlytics also has their LOC with PACW. I don’t believe this is any significant risk as PACW has enough liquidity to cover all deposits, the government is trying very hard to not let FRC (a walking zombie) fail, so I doubt they let PACW fail and lead to depositor loss, and Cardlytics can simply store cash in treasuries or some other short term liquid investment. The odds that Cardlytics runs out of liquidity due to depositor loss strike me as exceptionally low. Then again a certain someone likes causing bank panic

Cardlytics could simply fail at creating a compelling ad product with the new ad server and consumers don’t care. Given that JPM spent millions and months of time on this, as well as Cardlytics, I struggle to see how that is the case. I have spoken to numerous former employees and advertisers and the underlying message is quite clear - the platform is very valuable but has been managed poorly. If you lay someone off and they say they hate you but wish they could have stayed for the opportunity, I generally find that positive. By no means is there an easy road ahead, but I also don’t think it’s drastically uphill.

Following the loss of SBUX, Cardlytics no longer has significant advertiser concentration risk, but could still be negatively impacted by advertiser wariness. Forgive the shitty drawing, but we love spirit around here, and the below captures how I think about Cardlytics revenue.

The red line would be underlying user engagement which by all accounts continues to grow, up 8.6% YoY in Q4 despite revenue down 8%. The blue line is advertiser willingness to spend. Currently I believe we are in a down cycle of that blue line, which creates ample snapback potential to reach the FCF neutral guide for Q3 (that was reiterated just this week). This is admittedly not data backed as management never gave us full engagement stats color in 2022 as promised! (It’s hilarious because they literally couldn’t technologically, which Lynne apparently didn’t know, again). Currently I believe some of Cardlytics’ largest customers include the likes of Marriott and other T&E companeis that may see rapid demand declines if we do indeed spark of a recession. That being said any temporary headwinds I believe are workable given the liquidity is fine outside of significant earnout mistakes.

There are also likely other hidden reflexive tail risks that are always underestimated like employees getting fed up with shitty stock options, business partners thinking you’re insolvent, etc. Deterioration can be invisible until too late, which is likely a big reason why base rates for -98% stocks not blowing up are pretty low. Generally however I believe -98% stocks are fundamentally broken businesses, not core growing monopolies with amazing unit economics.

Thesis Makers:

What I want to happen to show if I’m right

The biggest key to Cardlytics’ success is to launch the new ad server UI with JPM. This is currently rolled out to F&F and employees at JPM with general release expected sometime soon. Launching the new UI on Chase creates a proof of concept for other banks. Banks tend to be conservative entities, so having a clear reference point from one of the biggest banks in the US enabling the new server and new UI creates pressure on other banks to also get on the server and new UI. While we do not know what uplift will be created by the new UI and ad server, I find it safe to assume that if CDLX and JPM are investing time and resources into it, they have a strong belief it will be positive. We will be able to tell if this new UI has launched when JPM has images within their offers UI. Keeping track of developments here is absolutely critical, as if images launch we must immediately work on determining impact. A potential avenue for this is Similarweb.com which has shown Q1 web traffic > Q4 web traffic for Cardlytics’ offers web pages, with March stronger than December holiday shopping.

Cardlytics must grow revenue and control cost to be successful. Gross margins are historically 45-50% as the only split of revenue coming out are minimal server costs and bank revenue share. There is almost no incremental cost for serving an advertisement, so 45-50% of revenue growth falls almost directly to the bottom line. Currently I project Cardlytics burns about $10-15m per quarter due to high fixed costs in terms of engineers, data center and software expense, and S&M. Per the Q4 2022 earnings call, CDLX believes they can achieve FCF profitability in 3Q23 barring a poor macro environment. Karim has said that his #1 focus is on the balance sheet and reaching profitability, so if there is not progress made on this initiative it reflects poorly on his capabilities and may impact liquidity. For this we simply have to wait and see.

Cardlytics must continue to have better relationships with banks. Karim has called out that prior to his tenure relationships with banks were stale and not high level, and channel checks have indicated similar concerns. Given the banks fully control the app which CDLX resides in, relationships here are crucial. BofA tried competitor Figg in 2021 and 2022, with JPM acquiring Figg in mid 2022. While we do not know the exact reasoning for these moves, CDLX at the time was undergoing significant technological headwinds and not iterating on their products, which may have led to bank frustration. Karim said on the Q4 earnings call “Banks are the most important assets of our business. The only way to create strong outcomes for Cardlytics is to create stronger outcomes for our partners.” Keeping track of positive channel checks from bank partners following the integration of the new ad server is imperative.

CDLX must continue to iterate on their tech stack and products. I have heard from formers that additional tech such as in app shopping support, offer filtering, SKU level offers, and more are possible. Whatever direction CDLX chooses to go, we must see evidence that they are innovating on the product. Previous management let the tech and product get stale in 2021 and 2022 which potentially lead to degradation of bank relationships and deprioritization of CDLX. If CDLX is unable to speed up release cadence going forward on the new ad server, which they have advertised as a tailwind, it speaks to serious innovation issues or unexpected difficulty working with banks and will likely lead to decreased revenue growth. Continuing to see progress in the tech and metrics shared by management would be a positive.

CDLX must continue to grow MAU’s to grow their addressable market. Part of the new ad server’s capabilities is faster rollouts of new partners. Karim mentioned on the Q4 2022 call that CDLX was in early talks with numerous top 20 US banks and fintechs. CDLX has also previously explored international expansion outside of the UK/US which represents billions of potential MAU’s. If CDLX is driving value for banks, it only makes sense for more banks to continue being signed and joining the platform. COF, AmEx, and Citi are potential candidates, with plenty of others. It is important however not to get distracted with MAU expansion.

While not a requirement, it would be a significant positive if CDLX is able to realize value from Bridg or other data partners. Currently margins are 40-45% due to partner share with banks. If CDLX is able to provide more of their own data, or monetize outside of the traditional CDLX model, it may lead to gross margin improvement. This is heavily speculatory and Bridg has only been used in limited test rollouts thus far, but any noted progress here would be indicative of both continued product innovation and potential for margin expansion.

Tracking these will naturally be difficult as an outsider without the assistance of management, as bank relations are generally opaque. At this point the proof is largely in the pudding and engaging with the new JPM product when it releases. Everything outside of that is secondary. We should get an investor day sometime in May as Karim needs to give an updated perspective and roadmap on the company following a new product regime. There are many places to go, and most point up.

Another source of incremental confidence has been continued executive hiring. Karim hired Amit Gupta over as COO from Stripe in January of this year. Amit formerly worked at Google and Stripe, so taking a role at Cardlytics in January to me indicates he was sold on the vision by Karim. I generally believe that is not something you do if there is a clear line of sight to imminent business failure, but this isn’t a certainty.

Thesis Breakers:

Below I outline events that would trigger an immediate break of thesis and must be carefully evaluated if they occur to determine actions.

CDLX losing a bank partner. To date CDLX has never lost a bank partner. Given there are currently no competitors, losing a partner would indicate CDLX was not providing value to banks, which would be a significant concern and likely an immediate sell if that bank is JPM or BofA

CDLX failing to launch the new UI on Chase. Previous management was entirely unreliable on product guides to investors and advertisers, and one would imagine to banks as well. If Karim fails to launch the new UI around late Q1 2023 as stated, that indicates that CDLX’s issues may simply be a complete lack of bank priority that isn’t solvable instead of Lynne specific issues. We have already seen the F&F and employee option rolled out and are awaiting a full release. The implied general release was sometime soon, so if it takes far longer that will impair revenue growth significantly and likely lead to them missing FCF neutral guides.

Earnout issues with Bridg. Currently CDLX is projecting a $39m cash payment in relation to their acquisition of Bridg in 2021. We do not know the extent of this disagreement, however given it is based on a 20x multiplier of ARR, if the ARR difference is say $7m instead of $6.03m, that would be a ~$20m difference in total payment, with 1/3 of that being cash versus ~$122m cash balance.

Additionally, there is a 2nd earnout payment that CDLX will owe Bridg based on 15x the ARR difference between May 2023 and May 2022. This payment is currently projected by CDLX to be $68m in total as of Q4 results. This payment again may be made by a combination of cash and stock, with cash being at least 30%. There is also a dilution cap, wherein CDLX can only issue ~6.6m shares to Bridg. Given the first payment is projected to be ~2.2m shares, this leaves ~4.4m available for the 2nd payment. If the 1st earnout payment dispute ends up creating a larger payment that must be covered in shares, it would lead to the 2nd payment requiring significantly more cash. Additionally if the 2nd payment is more than the $68m projected, that could cause significant cash outlay due to the maximum stock payment being ~$15m.

As an example, if the 1st payment is $146m vs $126m projected, CDLX would need to pay out $6m in cash as well as 350k shares. CDLX must then pay (350k*VWAP of April 2023) for the 2nd payment in cash due to limits on dilution. If CDLX burns 10-15m per quarter, this leaves them with 1-2 years of runway and heavily reliant on their revolver facility, which drastically weakens their ability to get through a significant market downturn.

There are many dynamic variables to track such as the 1st earnout resolution, the VWAP in April 2023, Bridg ARR for May of 2023, and revolver covenants. Many are not public.

Peter Chan, Jose Signer, Karim, or Amit Gupta leaving the company. The current thesis relies heavily on the assumption that the current management team will execute better on leading CDLX. If any of this team leaves that would be heavily concerning, as they came in to transform the company and have hired out much of the current employee base. The San Francisco engineering office is where the C-Suite is based out of and has hired numerous former Yahoo engineers. Amit Gupta was a direct hire by Karim in January 2023, thus if he leaves anytime soon that is likely indicative of problems.

Ongoing DD:

Some examples of ongoing research (not all inclusive, the entire recipe isn’t free)

Look for churned engineers once every 6-12 months to catch up on technological progress under new management. A core part of the thesis is that past growth was limited by the tech stack which has been drastically improved by more competent management. If that is not evidently the case, the thesis should be re-examined.

Go read Austin Swanson’s Substack

Review 1Q23 and 2Q23 earnings for any evidence of thesis breaking liquidity implications with respect to the Bridg earnouts. As projected currently these can be covered without a problem, however due to the 15-20x ARR multiples, any issues could quickly balloon if CDLX made significant errors.

Continue to passively track CDLX hiring, employee reviews, offers, and bespoke news sources for insights into any potential issues or proofs of execution. The business is highly volatile due to high uncertainty, so if certainty can be gained on an ~80% IRR, that is wildly valuable.

Buy calls in my PA like a silly goose.

Fin:

I planned on getting this out earlier this week, not 2am on a Saturday, but life just seems to happen like that sometimes. Thankfully here we are, 8,000 words and 2 spreadsheets later. The incessant headlines have been quite the ride and Cardlytics has melted down 50% over the last month. Thankfully the rest of my portfolio is holding up their injured brother (especially META, you’re a real one) and I’ve been an incremental buyer of Cardlytics in the PA over the last couple of weeks. Managed portfolio is unfortunately tapped out, but c’est la vie.

At this time I would say Cardlytics is the 2nd most attractive opportunity on public markets. The potential return is massive, but drastically better PMF of the new ad server is technically unproven even if intuitively sound and perhaps I am missing something if the stock just drifts down each day, but perhaps not as well. The most attractive opportunity I believe is CVNA, which basically just came out and said they’d be profitable in 2Q23. It’s a bit of an accounting trick, but the underlying data is exceptionally robust and indicates strong consumer demand irrespective of headlines.

If you appreciated this write-up, feel free to buy me 4 CDLX shares by subscribing and hopefully it’s the most expensive sub you ever place.

Until next time.

Hello Indra,

thx for sharing your thoughts.

I looked at the calculations with 2025e revenues of 677m - how does this fit with your projected 2024e revenue of 380m in your liquidity sheet? - do you really expect such a steep growth in revenue for 2025 or am I missing something?

Huge job, thank you very much